Weak data released on the Eurozone economy did not affect the positions of traders who continue to believe in the strength of the European currency, even though the Federal reserve's interest rates are likely to rise at today's meeting.

The main support for risky asset traders is from the expectation that tomorrow the European Central Bank will signal the curtailment of the asset repurchase program, which will allow in the future to start raising interest rates in the Eurozone.

In the first half of the day, rather weak data on the industrial production of the Eurozone were released, to which should pay more attention, since they could negatively affect the pace of economic growth in the eurozone in the second quarter of this year.

According to the report, in April of this year, industrial production of the eurozone decreased by 0.9% compared with March. Compared with April of the previous year, industrial production grew by 1.7%. Economists had expected production to fall by 0.7% in April, compared with March. As I noted above, the decline in industrial production, which accounts for almost a quarter of the euro-zone economy, could seriously affect economic growth, which has already significantly slowed down in the first quarter of this year.

The performance of US inflation continues to please traders, and the US Federal Reserve is likely to raise short-term interest rates by a quarter of a percentage point following the two-day meeting today.

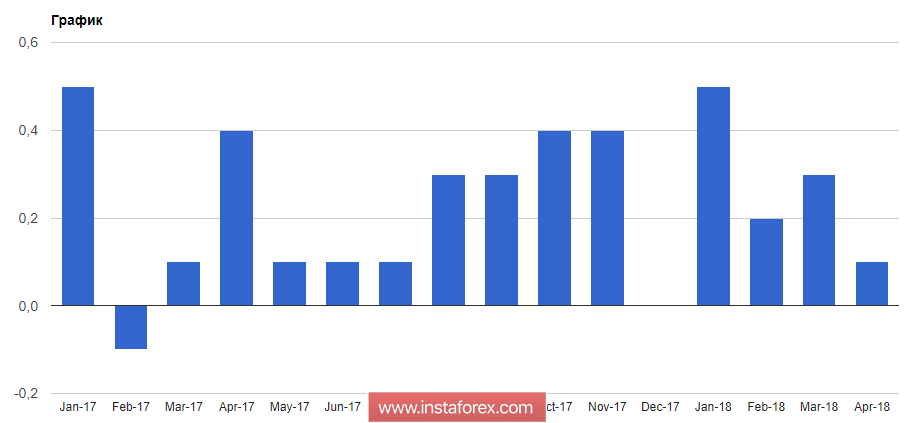

According to the report of the us Department of labor, the producer price index in May this year increased by 0.5% compared to the previous month. The core index, which does not take into account volatile categories, in May increased by 0.3% compared to the previous month.

Unsurprisingly, the rise in prices was due to a sharp increase in energy prices, which was observed in the first quarter of this year. Prices excluding food and energy in May rose by 0.1%. Economists expect that the producer price in May will grow by 0.3% compared to the previous month.

As I noted above, most of the market participants expect that today the US Federal Reserve will raise short-term interest rates to 2.0%. Immediately after that, Chairman of the Fed Jerome Powell will make a speech, from which many will wait for a signal for a sharp increase in interest rates throughout this year.

The British pound is not so lucky, it fell today against the US dollar after it became known that the annual inflation in the UK in May remained unchanged.

According to a report by the National Bureau of Statistics, the consumer price index increased by 2.4% in May compared to the same period of the previous year. The main decline was in the cost of utilities and food prices.