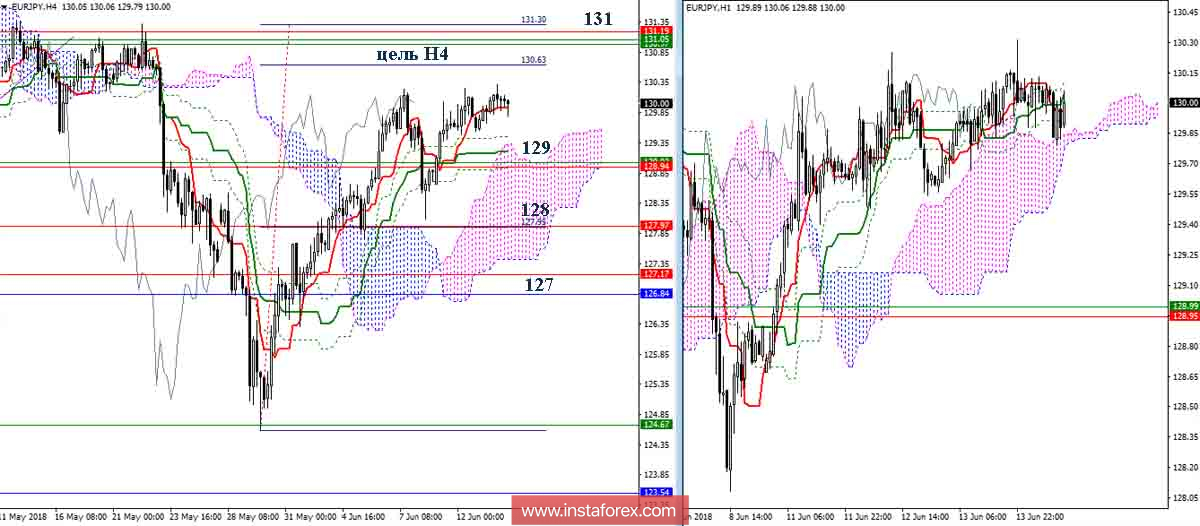

EUR / JPY pair

Players on the rise did not give up hope for the continuation of the upswing. The important point of which is the area of 131 (weekly Kijun 131.05 + Senkou Span A 130.96 + day cloud 131.19), but despite the daily maximum update, they can not close the day above the maximum last week's extreme (130.24). Together with the resistance of the higher timeframes, there still remains an untapped target for the breakdown of the H4 cloud. The weakness of players to fall by the end of the week may turn into a corrective decline, the targets of which will be the support levels of the daily cross 129 (day Tenkan + week Tenkan) - 128 (daytime Fibo Kijun) - 127 (daytime Fibo Kijun + month Fibo Kijun). The younger time intervals are in solidarity with this.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.