USD/JPY

In the first half of Thursday, the situation on the Japanese yen was overshadowed by the release of weak industrial production in China in May. Industrial Production slowed its growth from 7.0% y/y to 6.8% y/y against an expected smaller decline to 6.9 % y/y. But in Japan, the final report on industrial production for April showed an increase of 0.5% m/m against the previous estimate of 0.3%. The strong growth of the dollar after the ECB meeting and retail sales in the US (retail Sales for May 0.8%) radically changed the situation for the growth of markets. Today, the Nikkei 225 in the Asian session added 0.33%. Today, the Bank of Japan held a meeting on monetary policy, but there were no changes and new messages, and investors again shifted attention to the events in the US.

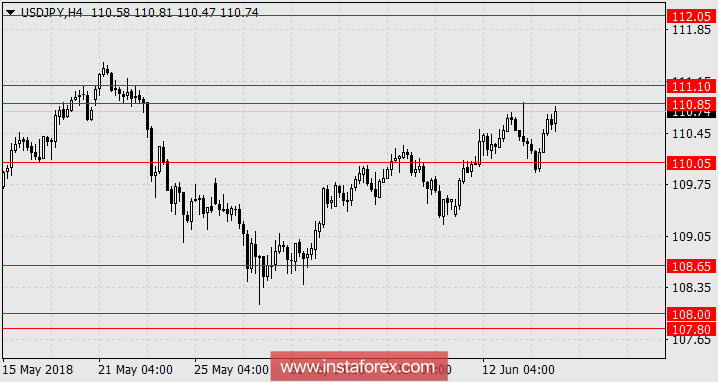

In the US, industrial production in May will be published today. An increase of 0.2% is expected with an increase in capacity utilization to 78.1% from 78.0%. We expect the yen to rise to 112.05 after overcoming the resistance zone at 110.85-111.10.