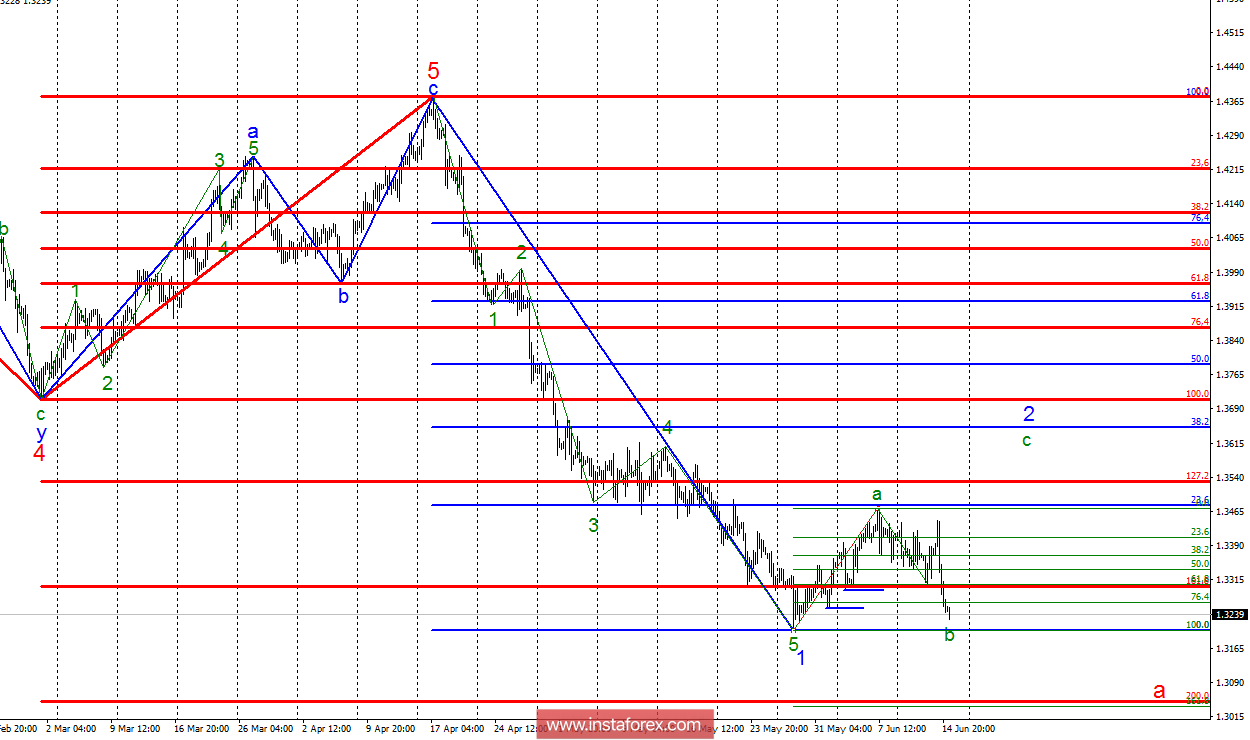

Analysis of wave counting:

During the trades on June 14, the GBP/USD pair lost about 200 bp, but remained within the framework of the proposed wave b, in 2. The break of the May 29 low is likely to mean a resumption of the construction of the downward trend section with the first targets about 1.3045. At the same time, wave 2, in a can take the form of one of the correctional triangles, which will allow to expect the construction of its internal wave s with the targets located near the estimated mark 1.3651.

Targets for buying:

1.3478 - 23.6% by Fibonacci

1.3528 - 127.2% by Fibonacci of the highest order

1.3651 - 38.2% by Fibonacci

Targets for selling:

1.3045 - 200.0% by Fibonacci of the highest order

General conclusions and trading recommendations:

The assumed wave 2, however, can take a more complex form. A successful attempt to breakdown 32 figures can confirm the transition of the instrument to the construction of the supposed wave 3, at a with the targets being around 1.3045, which is equivalent to 200.0% Fibonacci. At the same time, there are still some chances to build a wave c, in 2 with the exit of quotations to 1.3651. Trade should now be conducted carefully, as there are two practically equivalent options for the development of events.