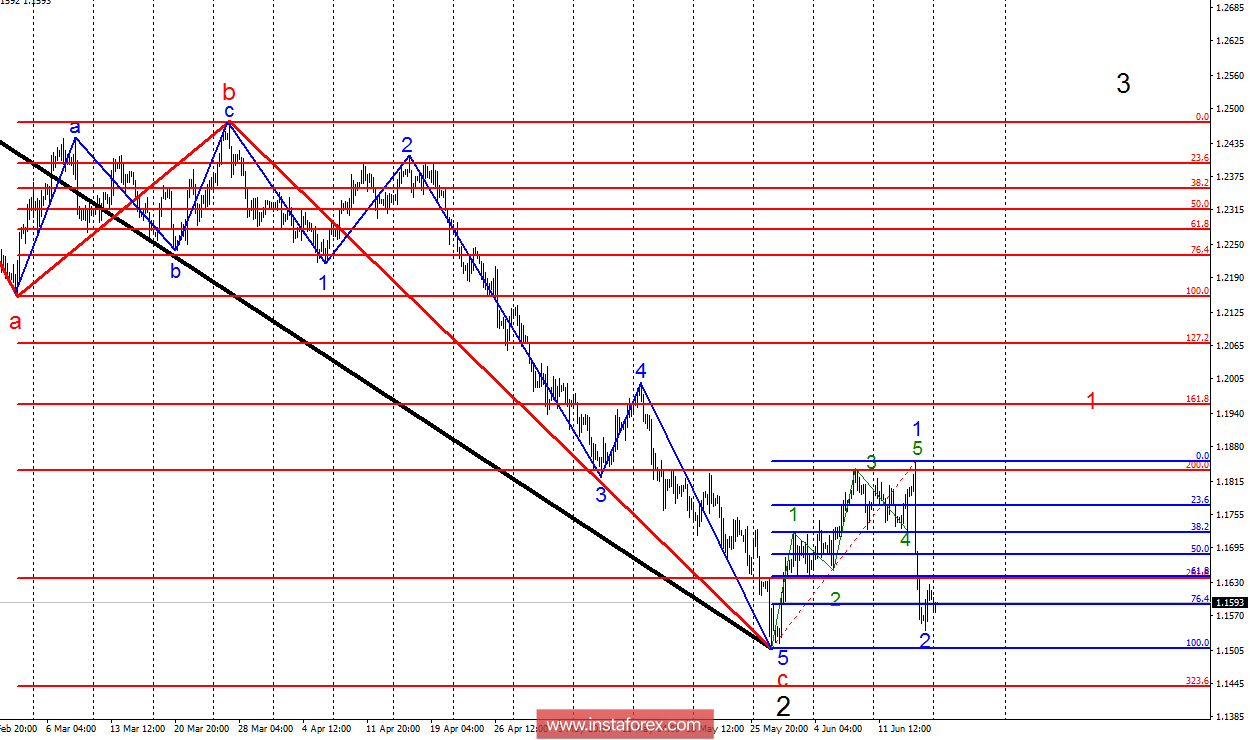

Analysis of wave counting:

As a result of the previous trading day, the currency pair EUR / USD added about 60 percentage points, thus saving a small chance of resuming the construction of the upward set of waves. Wave 2, in the future 1 turned out to be very strong, and in the course of its construction, the quotes dropped almost to a minimum wave 5, c, 2. Breakthrough the minimum of this wave will lead to the need to make adjustments to the current wave counting. So far, this has not happened, bulls still have a chance of raising quotes within wave 3, in the future 1 with targets above 19 figures.

The objectives for the option with sales:

1.1439 - 323.6% of the Fibonacci of the highest order

1.1121 - 423.6% of the Fibonacci of the highest order

The objectives for the option with purchases:

1.1958 - 161.8% of the Fibonacci of the highest order

1.2070 - 127.2% of the Fibonacci of the highest order

General conclusions and trading recommendations:

The EUR / USD currency pair is supposedly close to the completion of wave 2, 1, 3. If this assumption is correct, then the current pair price values are very attractive for the formation of purchases with targets located around 1.1958 and 1.2070, which is equivalent to 161.8% and 127.2% of Fibonacci. The break of the minimum of May 29 will lead to the complication of the wave 5, c, 2 and the entire descending section of the trend. In this case, I recommend resuming sales with targets of 1.1439 and 1.1121.