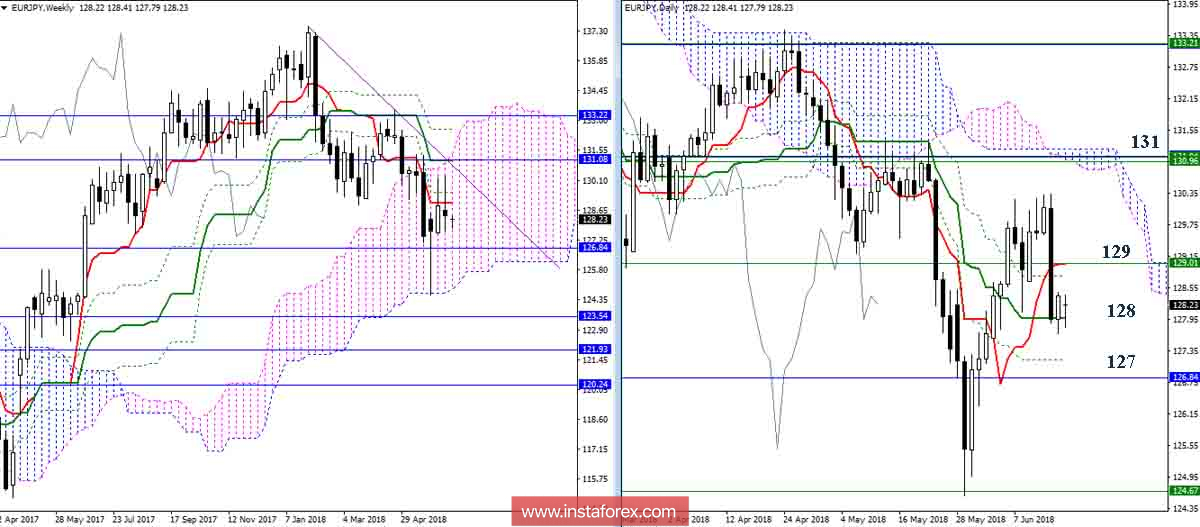

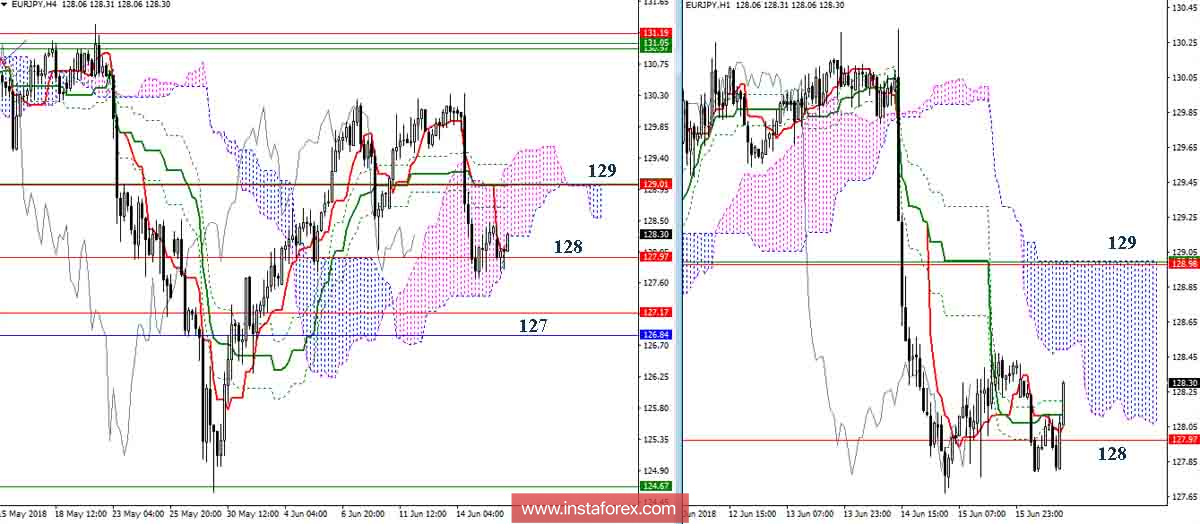

EUR / JPY

At the end of last week, the pair reached support for the daytime Kijun (128). As a result, we observe the development of inhibition. An important resistance is now the area of 129 (day + week Kijun). The fastening above will allow us to consider the possibility for a new upsurge, which continues to be guided by the region of the combined efforts of the daytime cloud (131.19), the weekly Kijun (131.05) and the monthly Tenkan (131.08). In case the bears now decide to continue the decline, since a certain advantage continues to remain on their side, the area of nearby supports should be noted at 127 (Fibo Kijun day + week). The situation at the lower time intervals only confirms the strengthening of bearish sentiments in the breakdown of the current support (128), since this will allow adding a downward target to the breakdown of the H4 cloud to the benchmark of the senior times (area 127).

Indicator parameters:

All time intervals 9 - 26 - 52

The color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

Clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines:

Support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

Horizontal levels (not Ichimoku) - brown,

Trend lines - purple.