Eurozone

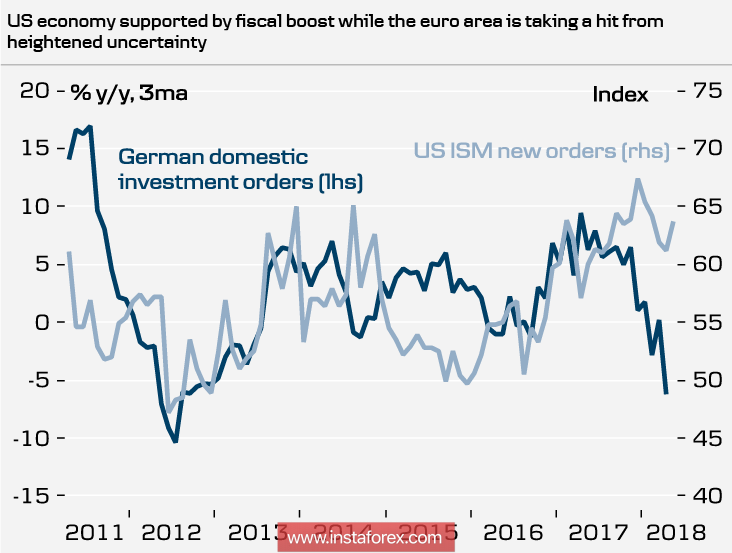

The euro resumed its selloff on Monday, finding no reason to resume corrective growth. The softer than expected results of the ECB meeting led to the fact that the difference in the monetary policies of the ECB and the Fed becomes even more pronounced. While the Fed is targeting markets for higher rate growth rates, the ECB does not plan the first rate increase earlier in the summer of 2019, and most likely in December 2019, that is, after about a year and a half.

This difference in hikes reflects the state of the two economies. The Fed raises macroeconomic forecasts, the ECB is forced to seek explanations for a slowdown in economic activity in the conditions of ultra-soft policy. Moreover, at a press conference, Mario Draghi did not rule out the possibility of an even weaker economic growth in the eurozone and stressed that at any time, it is possible to resume the asset repurchase program. Such sentiment did not support the euro.

Today, the ECB forum starts, which will last three days, where a number of leaders of the world central banks are expected to speak. As no important macroeconomic publications are expected this week, attention will be directed both to the comments of Mario Draghi, who will speak at the forum three times, and to the growing threat of the deployment of trade wars between the US and its trading partners.

In these conditions, markets are expected to decline, the threat of collapse of stock markets and prices for commodities is growing, the euro is under pressure. The euro may fall to 1.1350 in the next couple of days, there is no reason to resume growth.

United Kingdom

The most important event for the pound this week will be the meeting of the Bank of England on Thursday, June 21. The rate increase is not expected before December, and therefore the focus will be on the accompanying minutes.

After the May meeting, at which it was decided to leave the interest rate level unchanged, it turned out that inflation has decreased slightly, and the unemployment rate had risen, and even good data on retail sales in May, showing growth to 3.9% year-on-year, do not give reason to assume that the purchasing activity of the population is sufficient to resume economic growth and inflation.

The situation with Brexit will get more attention closer to the EU summit on June 28-29, currently the pound reacts more to external factors than to internal ones. The pound may update the local low from May 29, falling below 1.32, but a deeper decline is still in doubt.

Oil

Oil has updated the two-month low against the background of the general strengthening of the dollar across the entire spectrum of the market and the wave of speculation about the future increase in OPEC+ production. The decline, however, was shallow, since OPEC + is likely to exert all efforts to ensure that the fluctuations in quotations were insignificant. The main task of OPEC + is to ensure that oil prices get rid of excessive volatility at a level that suits both producers and consumers. On Friday, OPEC + will open its next meeting, the markets assume that the current agreement will remain in place until the end of the year, and the expansion of production will be slow and will begin no earlier than next year.

Brent may decline in the coming days to 70.70 dollars per barrel. as part of the correction, but the overall trend will continue to grow.