USD / JPY

Yesterday, the Japanese data on the trade balance came out mixed. Exports increased from 7.8% YoY to 8.1% YoY against expectations of a decline to 7.5% YoY according to estimates in May. But imports increased from 5.9% YoY to 14.0% YoY, which eventually amounted to a negative balance. The seasonally adjusted balance was -0.30 trillion yen against the forecast of 0.14 trillion yen and 0.45 trillion yen a month earlier. Excluding seasonal fluctuations, the trade balance was -578 billion yen against 625 billion yen in April. The yen was currently down by 40 points, but the day was closed by a decrease of 11 points thanks to external support.Today, the Asian markets played well with the statement of Donald Trump to impose a 10% tariffs on Chinese goods for another $ 200 billion. China announced the preparation for a reciprocal measures. The Chinese stock index, China A50 is losing 2.12%, and the Japanese Nikkei 225 by -1.03%. The yen declined by 75 points.

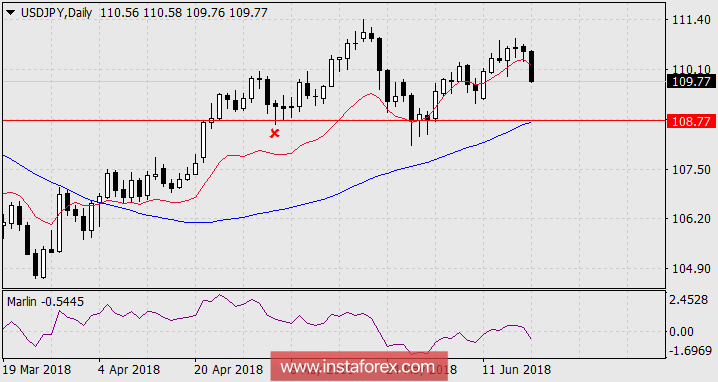

The first support price can serve as the line at the intersection with the minimum level on May 4 in the area of 108.77. The signal line of the Marlin oscillator bounced back to the negative territory.

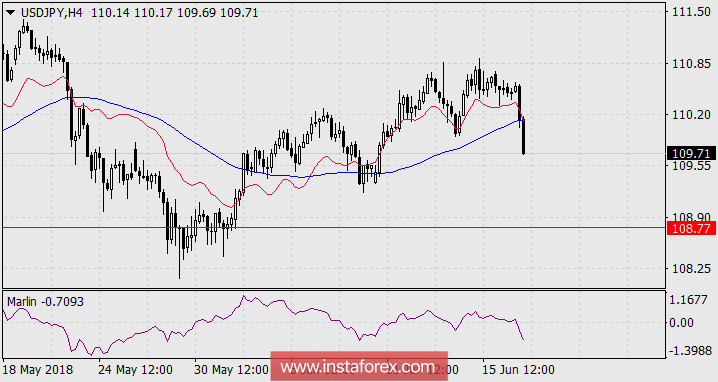

The 4-hour chart does not show any signs of reversal:

* The presented market analysis is informative and does not constitute a guide to the transaction.