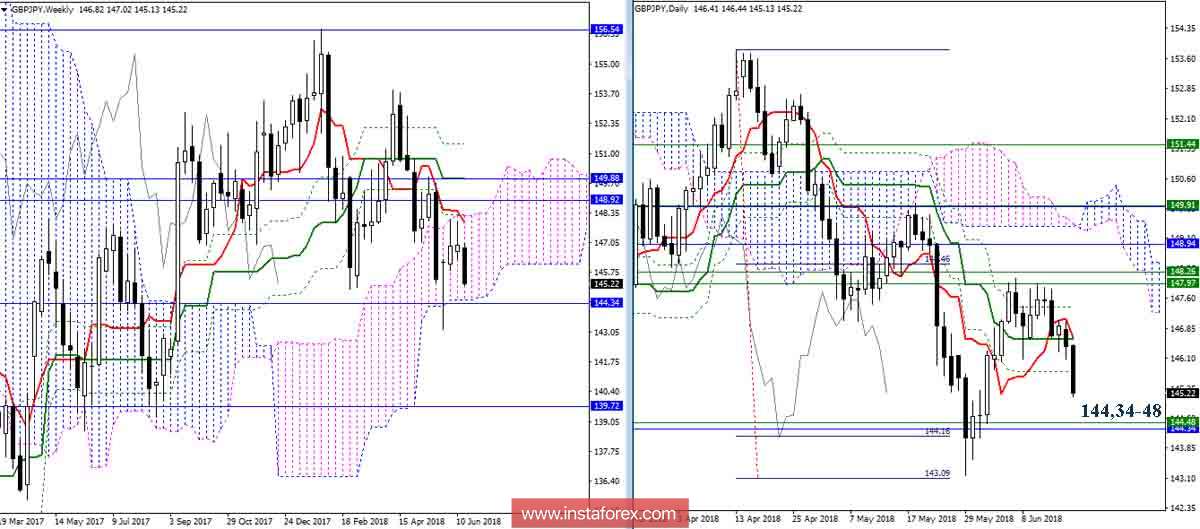

GBP / JPY pair

Deceleration was short-lived, the bears retained their advantages and are continuing to decline. The key area today is the support area of 144.34-48 (monthly Kijun + the lower boundary of the weekly cloud). In the case of breakdown and consolidation below the weekly cloud, a new downside target will be formed (the goal for the breakdown of the weekly cloud). On the way to fulfill this goal, the bears will have to resolve the issue of liquidating the monthly golden cross (Fibo Kijun 139.72). If the players on the downgrade in the current situation keep the pair in the weekly cloudiness and will not be able to overcome the support (144.34-48). The most urgent again will be testing the opposite border.

The lower time intervals on all of the elements of the Ichimoku indicator and currently support the players for a fall. A downward target has been formed for the breakdown of the cloud. Execution of the goal will lead to a couple in the support area of the senior half times 144,34-48, which once again confirms the importance of this milestone. The most significant resistance level for today can be noted at 145.78 (cross N1 + daytime Fibo Kijun) - 146.10 (Tenkan N4 + Senkou Span B N4 - Fibo Kijun N1) - 146.60 (Kijun N4 + cloud N1 + day cross levels).

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.