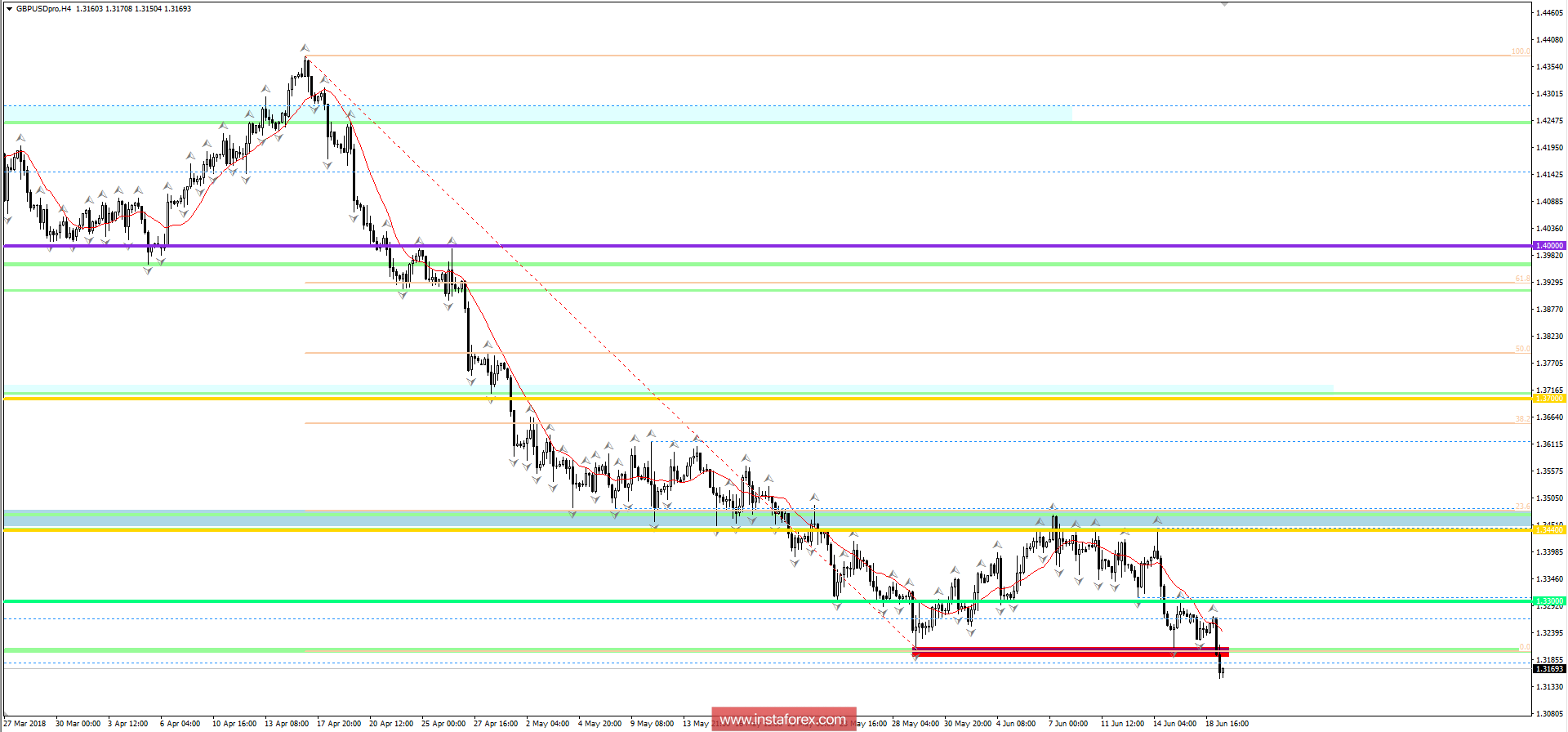

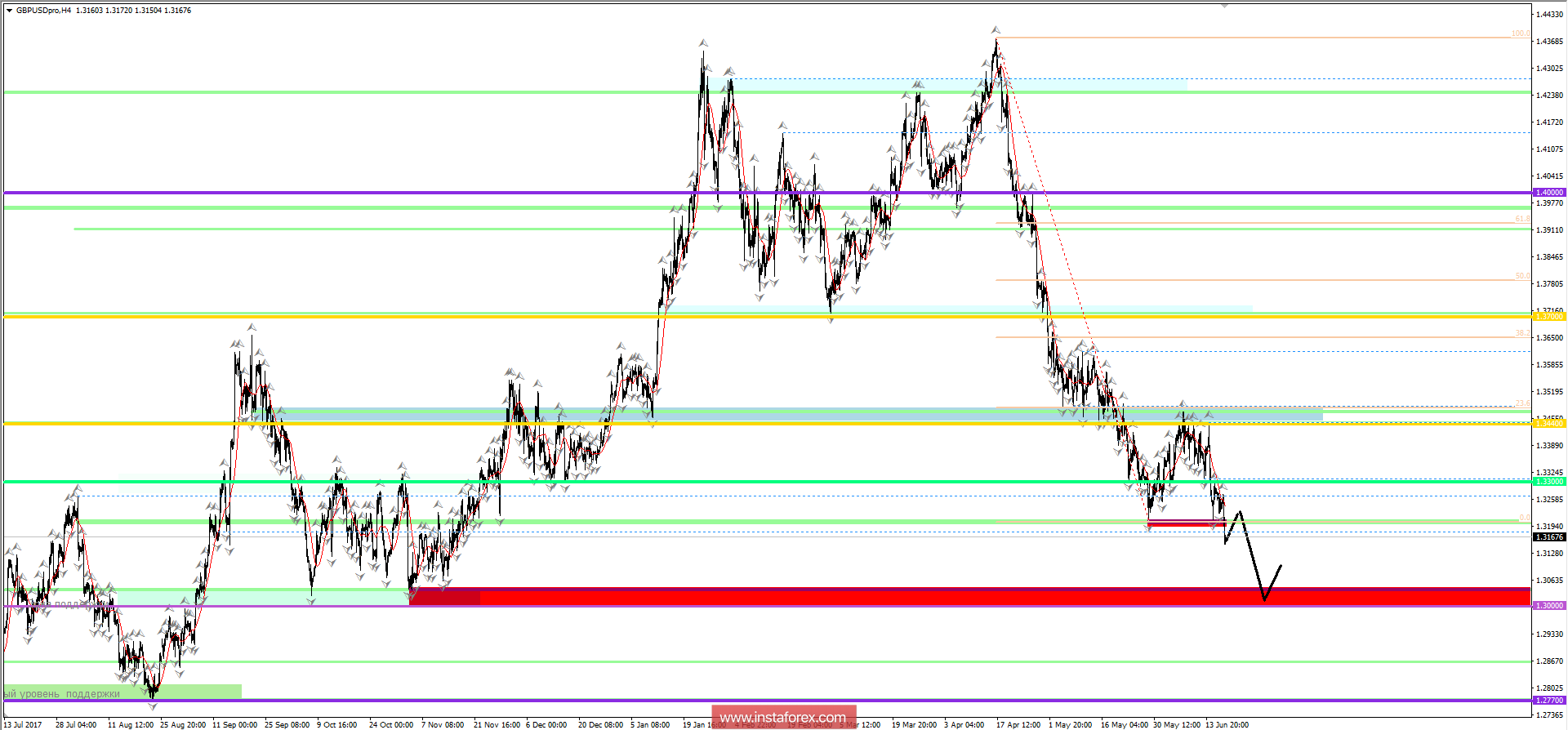

The Pound / Dollar currency pair after a short stagnation within the periodic level of 1.3300 managed to restore a downward interest. Whereas a result, we finally managed to overcome the local minimum of 1.3200, reflecting us the range of 1.3200 / 1.3220. What was this connected with? In fact, it's hard to say, I tend to believe that money runs into a quiet harbor. In this case, it's an American dollar. Let's look at Europe, on the one hand, Mario Draghi with his quantitative easing program and slow consideration of the interest rate. On the other hand, Theresa May, with her hunger talks on Brexit and inconsistency with her own party. All this leads to a flight and the current increased volatility.

Further development

At the moment, we have a breakdown at 1.3200 level, behind the solid pulse candles. The descending mood will continue, and I'm sure of that, but probably before any decisive action, we need a regrouping. I mean a rollback to the recently broken level of 1.3200 or stagnation within the current coordinate. But what awaits us after? Now, that's interesting, with the resumption of the "bearish" attitude, I guess, somewhere lower than 1.3130, we'll come down pretty quickly to the psychological range level of 1.3000 (1.3000 / 1.13050), where already on this site, I assume a significant stagnation with subsequent recovery.

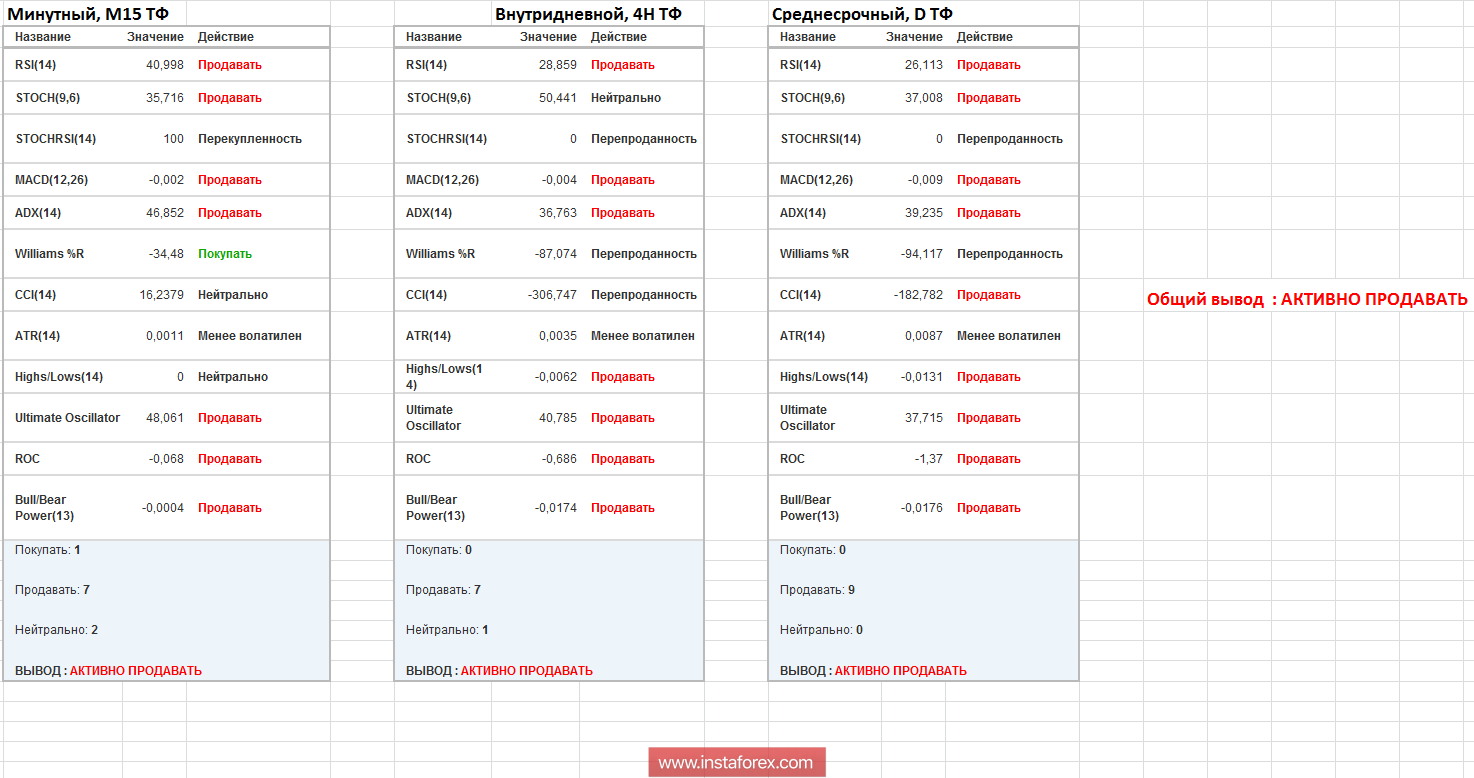

Technical picture

Analyzing the different sector of timeframes (TF), we see that the indicator analysis is prone to further decline, although I assume that the pullback to the level of 1.3200 is primarily waiting for us.

Key Levels

Resistance zones: 1.3200; 1,3300 *; 1.3440 **

Support zones: 1,300 ** (1,300 / 1,13050)

* Periodic level

** Range level