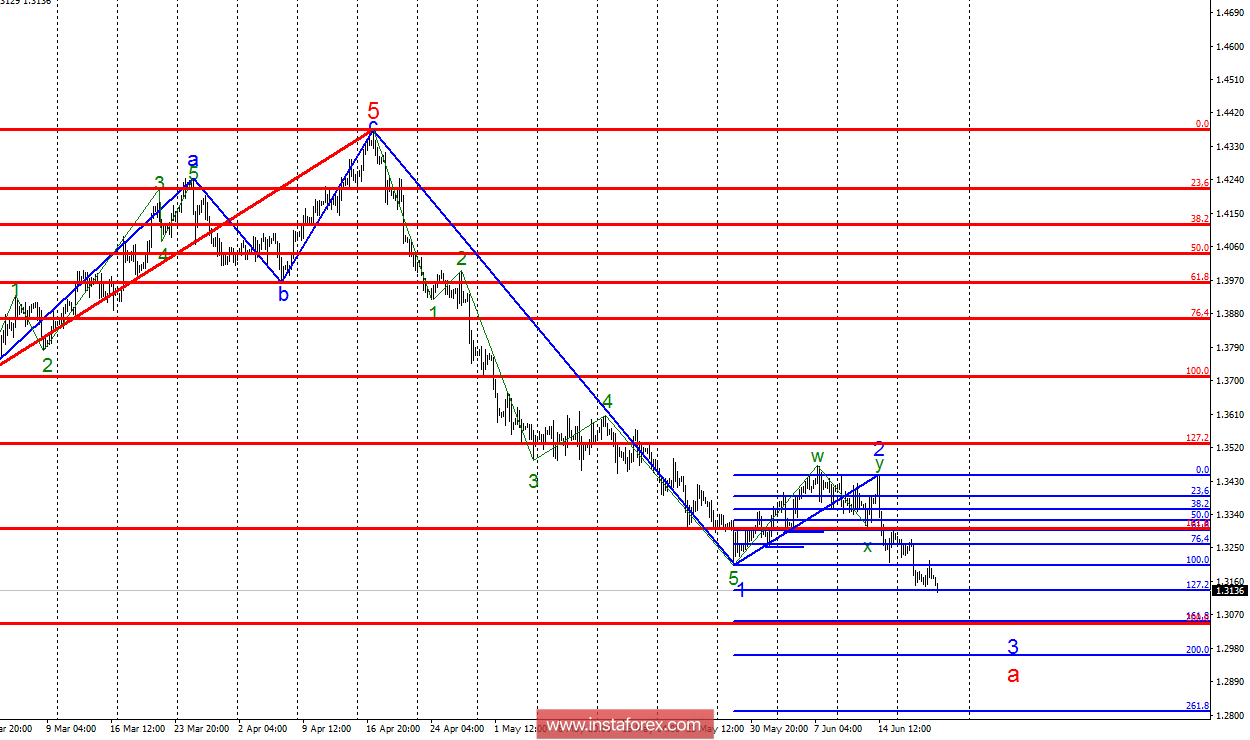

Analysis of wave counting:

During the trades on June 20, the GBP / USD currency pair was without losses, but this does not change anything in the current wave counting. Wave 2, in the future a, supposedly completed its construction, so the pair went on to build the wave 3 with targets that are around 1.3054 and 1.2962. Wave 2 took a much shorter kind, which proves the absolute "bearish" mood for the pair GBP / USD. Further prospects for the pair's movement largely depend on the nature of the fundamental events in the US and the UK.

The objectives for the option with purchases:

1.3204 - 100.0% of Fibonacci

1.3258 - 76.4% of Fibonacci

The objectives for the option with sales:

1.3054 - 161.8% of Fibonacci

1.2962 - 200.0% of Fibonacci

General conclusions and trading recommendations:

The assumed wave 2, as we assumed, took a shortened form and with a high degree of probability completed its construction. Thus, now I recommend selling the pair in consideration of the proposed wave 3, a, with the targets located near the calculated marks of 1.3054 and 1.2962, which corresponds to 161.8% and 200.0% of the Fibonacci, built on the wave 2. An unsuccessful attempt to break through the mark of 1.3054 may lead to the withdrawal of quotations from the minimum reached.