While trade wars do not leave the front pages of world media, the Japanese yen will attract investors' attention. The risks of a slowdown in global GDP lead to an outflow of capital from developing countries-oriented ETFs and force carry traders to return to funding currencies. In such circumstances, even a zero profitability may be better than its sharp decline in risky assets. Moreover, central banks, following a meeting in Portuguese Sintra, came to the conclusion that increased turbulence due to the impact of an escalation of trade conflicts can arise at any one time.

Donald Trump forced China to be silenced by its threat of imposing duties on imports at a rate of $ 200 billion, followed by an increase of $ 200 billion in the event that the Celestial Empire decides to take revenge. Taking into account the available $ 50 billion, the total amount is equivalent to 2.2% of the US GDP. If you add to it a possible 20% tariff for the supply of European cars to the States, you will get 4.1%. And this figure cannot be ignored in any way. According to the Financial Times, such measures, due to import prices, will accelerate American inflation by as much as 1 pp, make the Fed act aggressively and potentially lead to the strengthening of the US dollar by raising the rate for federal funds and reducing the negative balance of foreign trade. It's another matter if China and the EU adequately respond.

Let the Peterson Institute believe that a global trade war with tariffs of 10% for all product groups will reduce world GDP by only 2%, in fact, fear has big eyes. In the 1990s and in the 2000s, the dollar index lost 20% and 12% due to tariffs for steel and aluminum and due to the escalation of the conflict between the US and Japan. But the consequences for the world economy were even less.

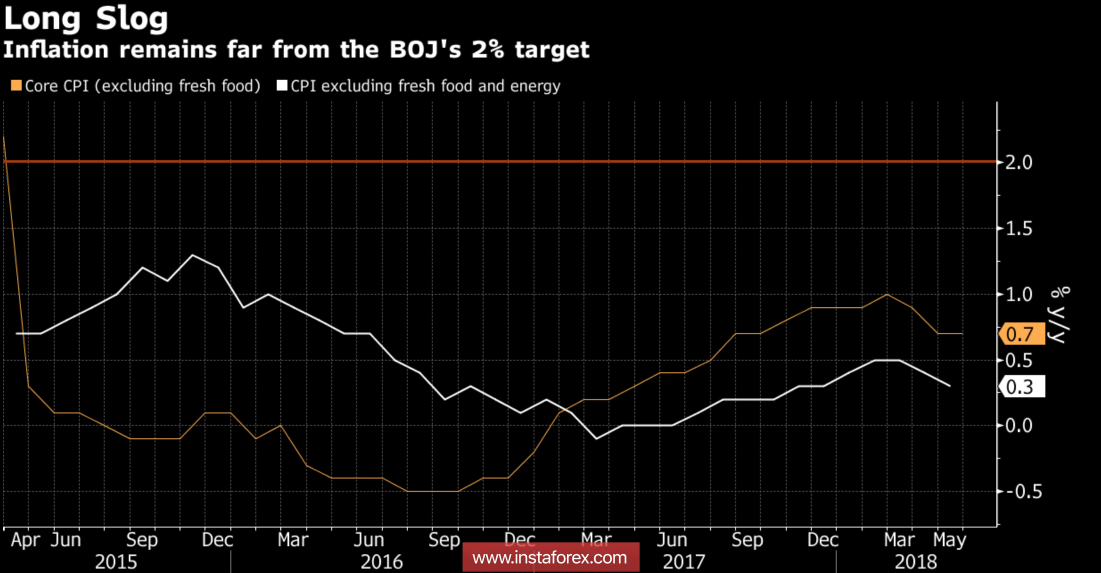

In this situation, the Central Bank sees the Central Bank as the country of the rising sun. Despite Haruhiko Kuroda's repeated promises, he never managed to reach the inflation target at 2%; in the last accompanying documents, as a result of his meetings, he no longer specifies the specific deadlines for meeting the target and tries to explain his defeat by population aging and deflationary thinking.

Dynamics of Japanese inflation

In fact, the root of all ills must be sought in a strong yen, which, due to falling import prices, hinders inflation. At the same time, retailers do not raise prices because of a slight increase in household incomes.

In my opinion, while investors weigh between the divergence in the monetary policy of the Fed and BoJ and trade wars, the pair USD / JPY is doomed to consolidation in the trading range of 107-112. Large-scale military actions or the understanding that the Federal Reserve will not rush to raise the rate and will push the analyzed pair to the lower border of this range.

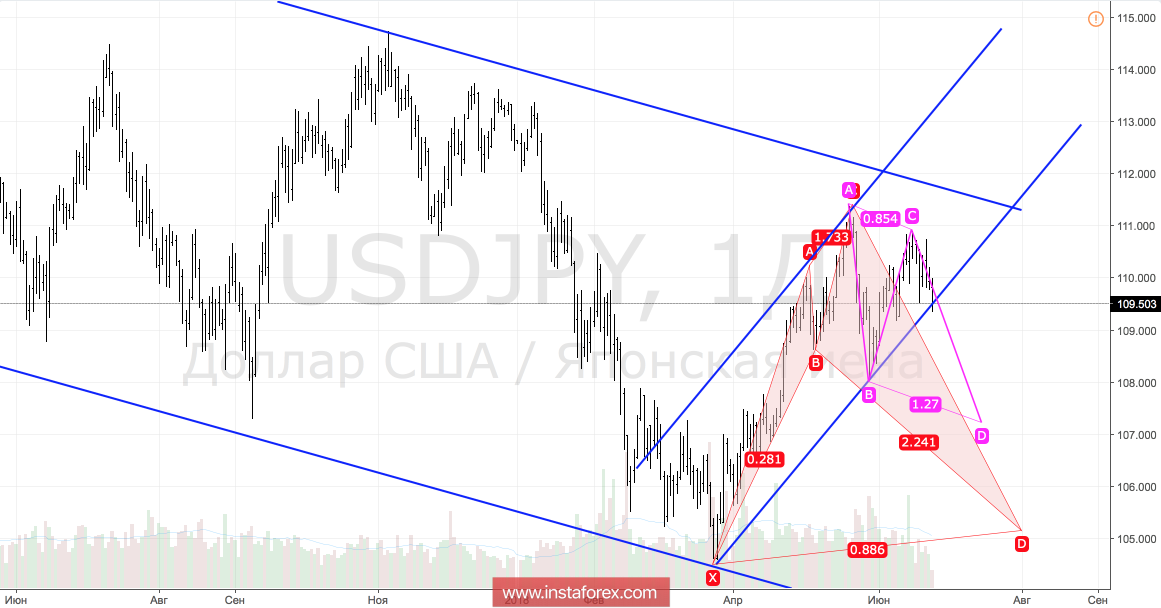

Technically, the breakthrough of diagonal support in the form of a lower border of the upstream trading channel will increase the risks of activation of the patterns AB = CD and "Shark". Their targets for 127.2% and 88.6% correspond to the levels of 107.2 and 105.2.

USD / JPY, the daily chart