Despite the weak statistics on sentiment in the business community in Germany, the euro rose against the US dollar, climbing to a fairly important level of resistance from which new buyers of risky assets can build a new upward wave.

According to the report of the IFO Institute, the index of sentiment in the German business community in June this year fell to 101.8 points from 102.3 points in May. Economists had forecast that the figure would fall even more, to 101.6 points. As stated in the Ifo's report, the positive impact on the German economy is weakening, which affects the expectations of companies in the manufacturing sector and the service sector.

Given the weak fundamental backdrop in the beginning of the trading week, traders positively perceived the statements made on Monday by a member of the ECB's monetary policy committee, Vitas Vasiliauskas, who heads the Central Bank of Lithuania.

The representative of the ECB said that he expected an increase in core inflation in the medium term, and therefore does not see the need to continue quantitative easing after December. Vasilauskas also noted that the quantitative easing program has its limits, but the ECB still has a number of other instruments, including long-term loans.

As for the risks, like his colleagues, Vasiliauskas mentioned trade conflicts that could change the current balance for the worse.

The report on sales of new homes in the US released in the second half of the day did not strongly support the US dollar, even though sales rose before the beginning of the summer period.

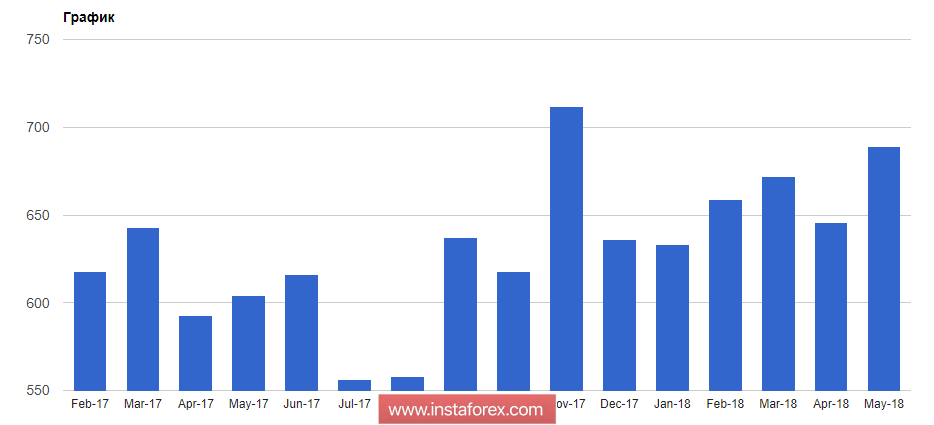

According to the Ministry of Commerce, primary home sales in the US in May 2018 increased by 6.7% compared to the previous month and amounted to 689,000 homes per year. Economists had expected that sales would grow by 0.9%. In comparison with the same period of the previous year, sales in May grew by 14.1%.

The report on business activity in the zone of responsibility of the Federal Reserve Bank of Dallas was also ignored by the market. According to the data, the index of business activity of the Fed-Dallas in June this year rose to 36.5 points, against 26.8 points in May. However, the production index in June, on the contrary, fell to 23.3 points against 35.2 points in May.

We have repeatedly noted a decrease in production activity in the United States, which may ultimately have a negative impact on economic growth for the 2nd quarter of this year.