The wave pattern of the H4 graph:

The vector of the main movement of the major euro pair is set by the bearish wave of January 25. In a larger model, this correction wave has a limited potential.

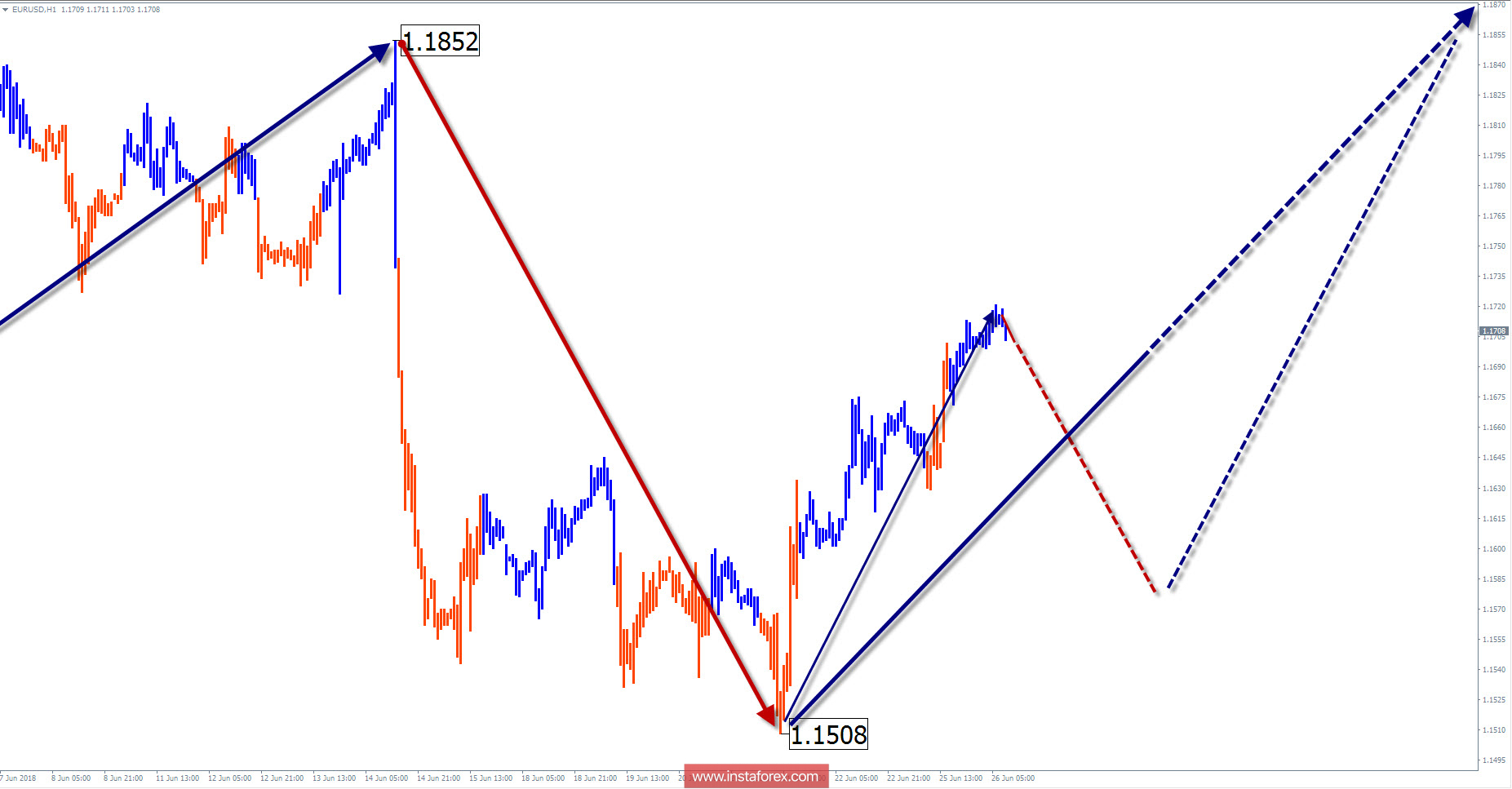

The wave pattern of the H1 graph:

The upward segment of the price movement from May 29 approached this scale of the chart. The wave has sufficient potential for the formation of a larger ascending structure. In the structure, the first 2 parts (AB) can be traced.

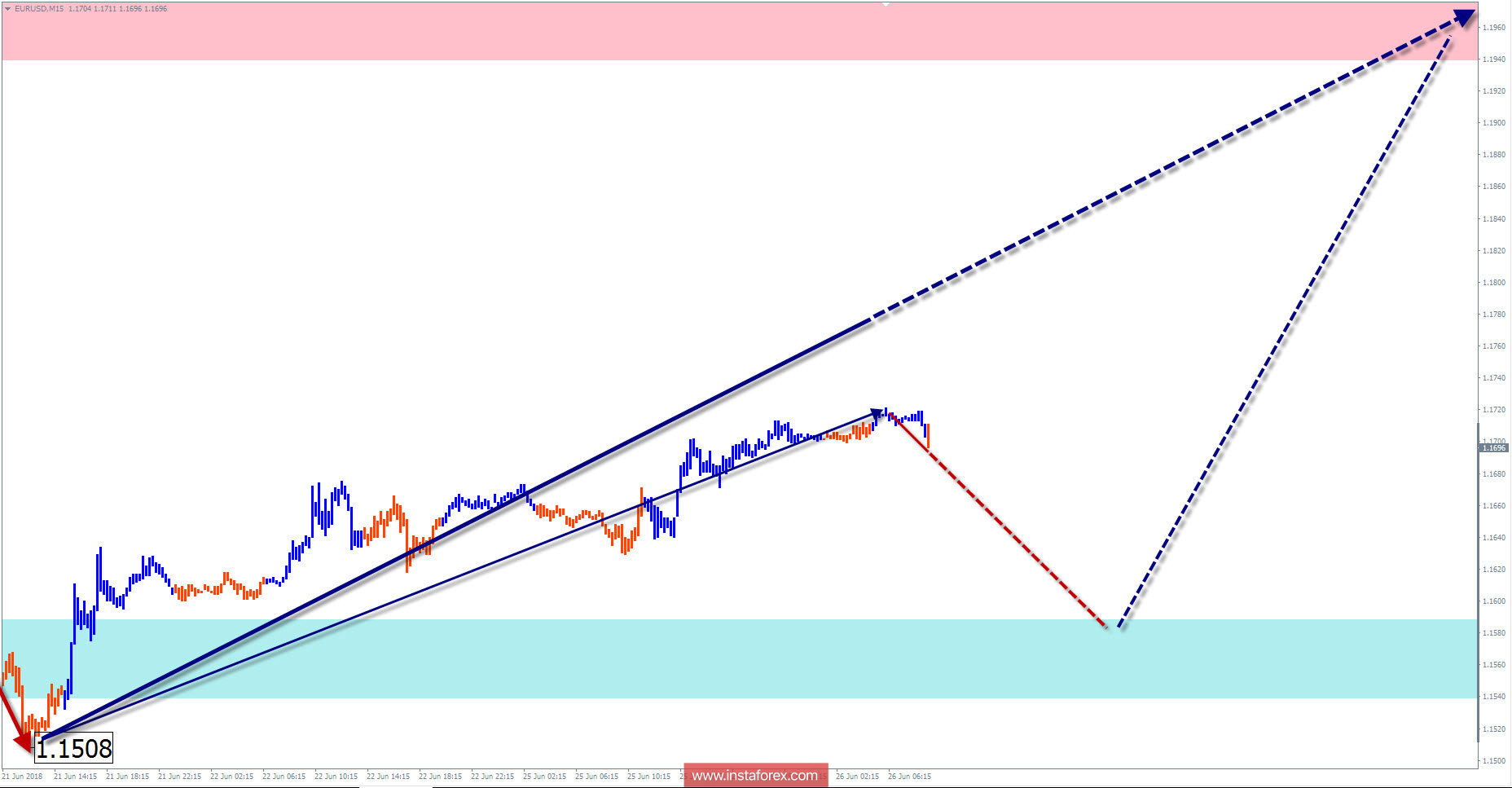

The wave pattern of the M15 chart:

The last wave from June 15 is upward. It forms the first part of the wave structure (A). In the coming days, you can expect a rollback to correction (B), after which, the uptrend will continue.

Recommended trading strategy:

Due to low downhill potential, sales are not recommended. For all styles of trading, the most promising is to look for buying signals of the pair.

Resistance zones:

- 1.1940 / 1.1990

Support zones:

- 1.1590 / 1.1540

Explanations to the figures:

A simplified wave analysis uses a simple waveform, in the form of a 3-part zigzag (ABC). The last incomplete wave for every time frame is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the counting of wave according to the technique used by the author. The solid background shows the generated structure and the dotted exhibits the expected wave motion.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need to confirm the signals used by your trading systems.