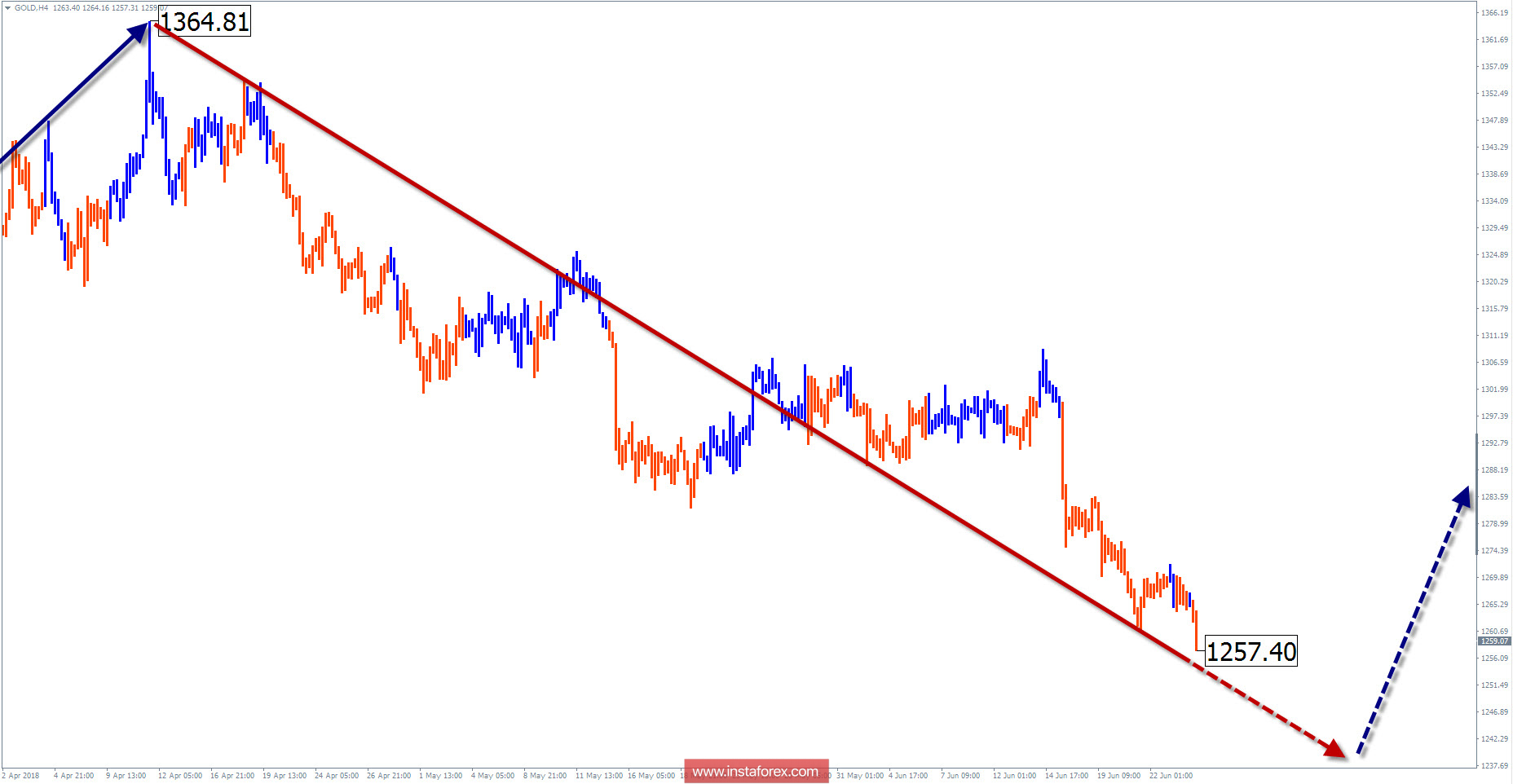

Wave picture of the chart H4:

The downward wave algorithm of January 25 gives the main direction of the short-term trend of the gold rate. In a larger model, this plot corrects the previous price rise.

The wave pattern of the graph H1:

Bear's wave of April 11 has a pronounced impulse appearance. The upper limit of the probable completion zone is within the calculated support zone.

The wave pattern of the M15 chart:

The wave of June 14 forms the final section of a larger wave of the trend. Correction part of the movement was completely hidden. It is not necessary to wait until the target zone of the course change.

Recommended trading strategy:

It is necessary to wait for the completion of the current bearish wave and to seek signals for the purchase of the instrument. Supporters of intersessional trade can make short-term sales.

Resistance zones:

- 1290.0 / 1300.0

Support zones:

- 1250.0 / 1240.0

Explanations to the figures: In a simplified wave analysis, waves consisting of 3 parts (A-B-C) are used. For analysis, 3 main TFs are used, on each one the last, incomplete wave is analyzed. Zones show the calculated areas with the greatest probability of a turn.

Arrows indicate the wave counting according to the technique used by the author. The solid background shows the generated structure, the dotted - the expected movements.

Attention: The wave algorithm does not take into account the duration of the tool movements in time. To conduct a trade transaction, you need confirmation signals from your trading systems!