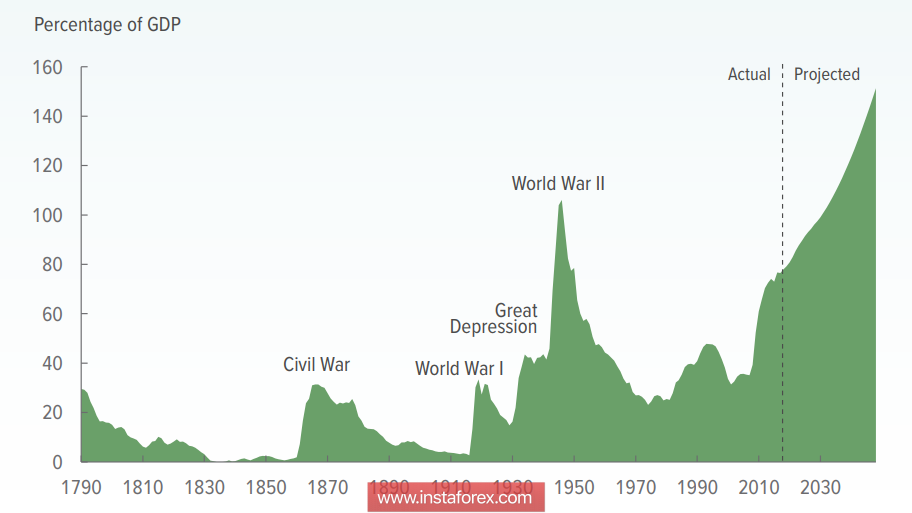

The Budget Committee of the U.S. Congress (CBO) released a semiannual update of projections for the state budget. As expected, the fears of the CBO are growing – in its opinion, if the current legislation remains unchanged, the US government debt will continue to grow to 152% of GDP in 2048 and the budget deficit – up to 9.5%.

And this is still an optimistic scenario - some markers suggest that both the debt and the budget deficit can start exponential growth, if the legislators refuse from the planned increase in income tax for 2026, and significantly exceed the estimated figures.

It should be emphasized that the forecast of the CBO gives taking into account changes in the tax legislation that were adopted recently. It is obvious that in order for events not to follow the worst-case scenario, the government needs a successful tax reform result by 2026, so successful that, without prejudice to the state's revenues, it will raise the income tax and begin to slow down the growth of public debt.

There are other obvious conclusions: a growing national debt will damage the economy and budget policy, national savings will decrease, and the government's interest expenses will increase significantly, bringing the onset of a new crisis.

The Trump administration has to hurry - Congressional elections are approaching, and the Republicans' loss of control over the parliament will significantly complicate the tasks of the administration in implementing the planned changes in the legislation. Trump can not allow this, and therefore will insist on changing trade agreements in favor of nationally-oriented elites.

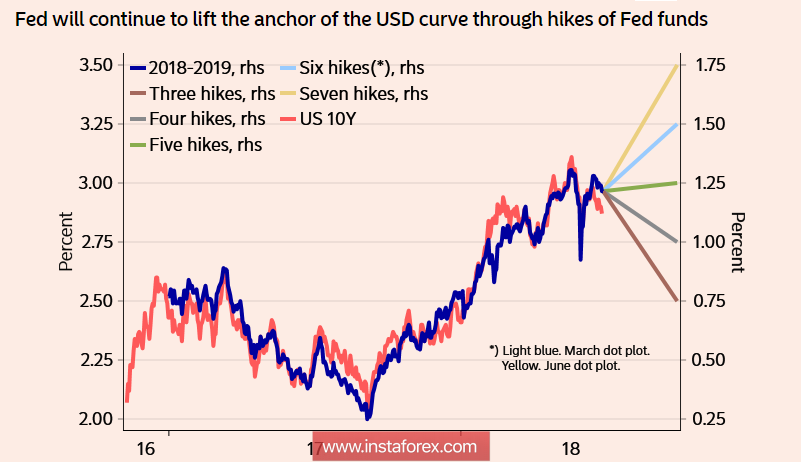

The slowdown in PMI growth suggests certain risks, but still does not prevent the Fed from adhering to the planned rate plan, which automatically pulls in the profitability of dollar-denominated assets. By the end of 2019, another 5 hikes are planned (two in the current year and three in the next), only a significant deterioration in macroeconomic indicators will change this scenario.

At the moment, such a probability exists, but it is not yet clear what will happen before - whether the decline in key indicators, including GDP growth, deterioration in the labor market, or a crisis in emerging markets that will increase demand for the dollar. The Fed is approaching a monthly write-off of $50 billion, this will happen before the end of this year, and, most likely, in any event, it will not be possible to avoid the strengthening of the dollar before the end of this year.

The currencies of developing countries suffer the most losses, as the worsening of global credit conditions, which is consistently implemented by the Federal Reserve, is directed precisely against these markets. The Bank of England recently announced that it intends to consider the issue of reducing the balance sheet, that is, in fact, to follow the path of the Fed and reduce the supply of capital.

Stock markets continue to fall, which is a sign of rising tensions. The decline in gold should not be deceived, in these conditions, this dynamics does not reflect a way out of the state of stress, but confidence in the further strengthening of the dollar.

On the part of the euro area, the dollar is unlikely to receive a counter-rate to strengthen the euro. The ECB announced the termination of bond purchases by the end of 2018, but the increase in rates of clarity was not more, but less, and if earlier the markets were oriented for June 2019, now the expectations for the first increase have shifted to August. At the same time, the eurozone is experiencing obvious problems – the PMI is declining, the yield of bonds has rolled back from recent highs, all hope for inflation, which is now slowly but surely rising due to the growth of energy prices. The euro will be cheaper against the dollar, the consolidation below 1.15 is a matter of the near future.

On Wednesday, the eurusd will likely trade in a range of 1.1630/1690 by gravity to its lower boundary. The pound, most likely, will also go into a sideways range with a slight decline towards 1.3180.