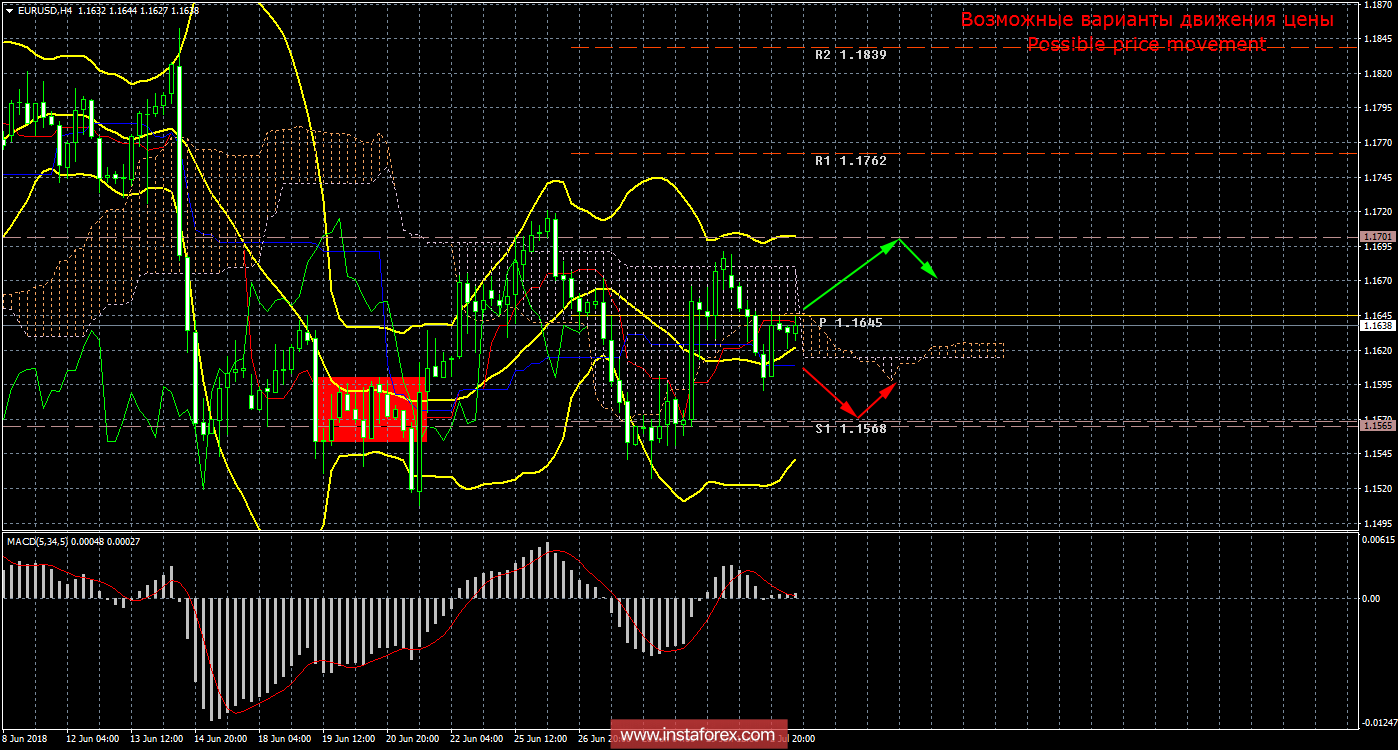

4-hour timeframe

Amplitude of the last 5 days (high-low): 86p - 131p - 74p - 133p - 98p.

The average amplitude for the last 5 days is 104p (102p).

On the first trading day of the week, there were few macroeconomic reports in the world. Nevertheless, the EUR / USD currency pair showed quite high volatility, which means the presence of a large number of traders on the market. The index of business activity in the EU production sector decreased compared to the forecast, and the analogous ISM index in the US, on the contrary, was significantly higher than the experts' expectations. In Europe, unemployment was still published, but traders did not pay attention to it, since, despite the decline, it still remains at a fairly high level - 8.4%. And the most interesting information continues to come from US President Donald Trump. Trump continues to make extremely inconsistent statements, putting himself at the head of the whole world. First, on Friday, July 6, the new trade sanctions of America against China for the total amount of $ 50 billion will begin to operate. Trump, I'll fight, said that if China responds to these sanctions, then the States will introduce new trade restrictions. Trump still believes that America is an outsider, and trading partners are using dishonest trading conditions. It is this "injustice" that Trump wants to change. Secondly, Trump demanded that all countries that introduced trade duties against America immediately remove them, probably considering that only he decides who and against whom to impose duties. Thirdly, the US president spoke out harshly about the EU, saying that in matters of trade the European Union is "as bad as China." The leader of America still believes that the EU is dishonest with the Americans, while the States are spending huge amounts of money to support NATO. In general, it seems that the trade war will only gain momentum, but it will be only time to whom it will be worse than the rest.

Trading recommendations:

For the currency pair EUR / USD, it is recommended to consider purchase orders with a target of 1,1701. The signal for the opening of purchases will be the fixing of the price above the pivot level of 1,1645. Bulls, as before, are now very weak, so we open longs in small lots.

Shorts are recommended to open if the bears manage to gain a foothold below the critical Kijun-sen line. In this case, the downward movement can continue to at least support level 1.1568.

In addition to the technical picture, one should also take into account the fundamental data and the time of their release.

Explanations to the illustration:

Ichimoku Indicator:

Tenkan-sen is a red line.

Kijun-sen is a blue line.

Senkou Span A is a light brown dotted line.

Senkou Span B - a light purple dotted line.

Chinkou Span is a green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and histogram with white bars in the indicator window.