Given that yesterday in the US, Independence Day was celebrated and in the absence of American traders, market was completely calm. There were some interesting data on Europe, which already today will be taken into account by the market. t is about the data on the index of business activity in the service sector of the euro area, which increased from 53.8 to 55.2. Together with it, the composite index of business activity grew from 54.1 to 54.9. Thus, a single European currency has many reasons for growth.

Today, the turn of US statistics is to please market participants. Therefore, ADP's employment data should show its growth by 190 thousand against 178 thousand in the previous month. But along with such good data, there is data on the number of applications for unemployment benefits. It is expected that the number of initial applications may decrease from 227 thousand to 225 thousand, but the number of repeat ones will grow from 1,705 thousand to 1,720 thousand. The total balance should grow by 13 thousand. Meanwhile, the non-productive sector drop from 58.6 to 56.5, and the composite index of business activity from 56.6 to 56.0.

Hence, it is clear that the forecasts are negative, at least for the dollar. Of course, we can assume that today's publication of the text of the minutes of the meeting of the Federal Commission for Open Market Operations will help the dollar. However, this is unlikely. The fact that the Fed's policy is completely transparent and there are no surprises on the horizon. Everyone already knows that by the end of the year, the Federal Commission for Open Market Operations will once again raise the refinancing rate, so there will be nothing new in the content of the text of the protocol.

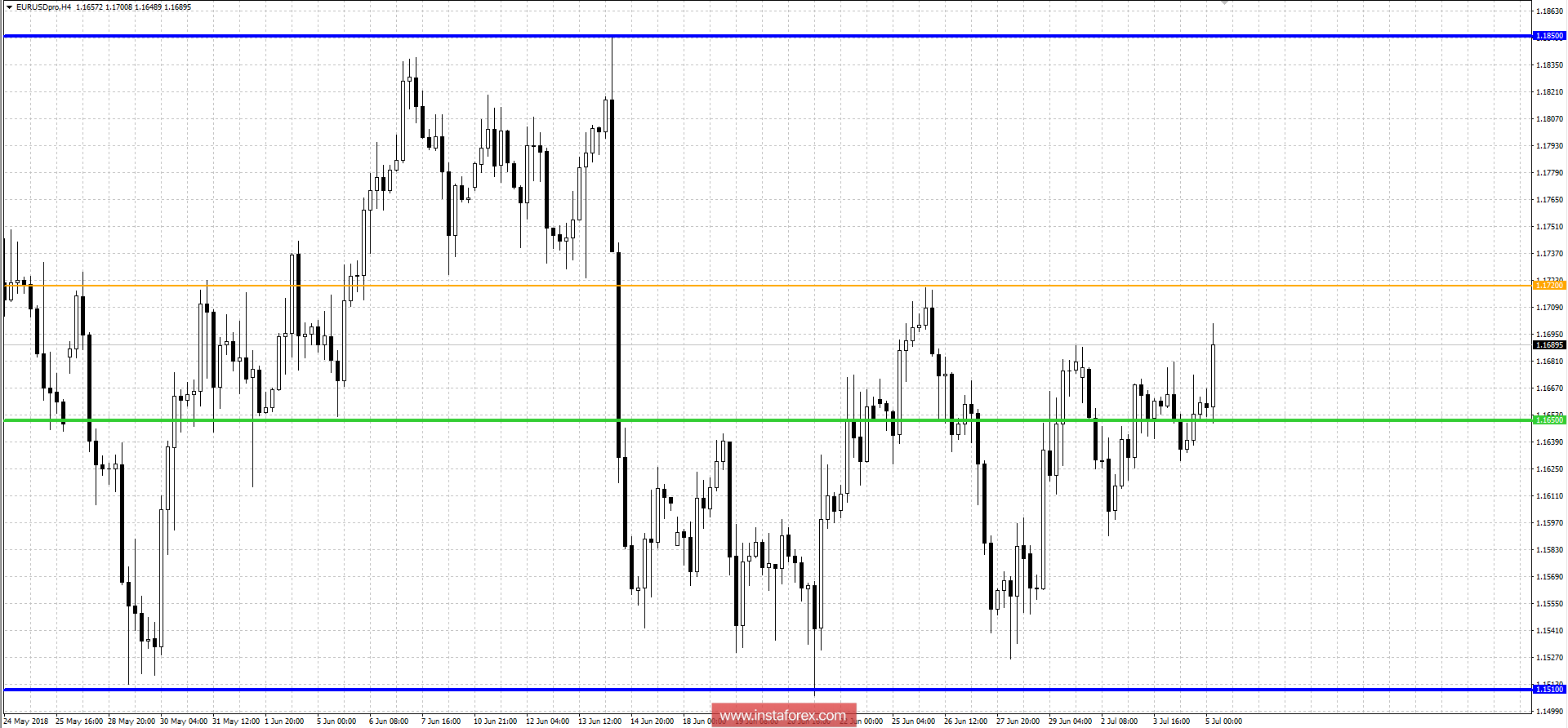

After stagnation within the level of 1.1650, the EUR/USD currency pair managed to break free extended the upper limit of the chart to 1.1680. We can assume a further move to the periodic level of 1.1720, where one can already expect stagnation within it.