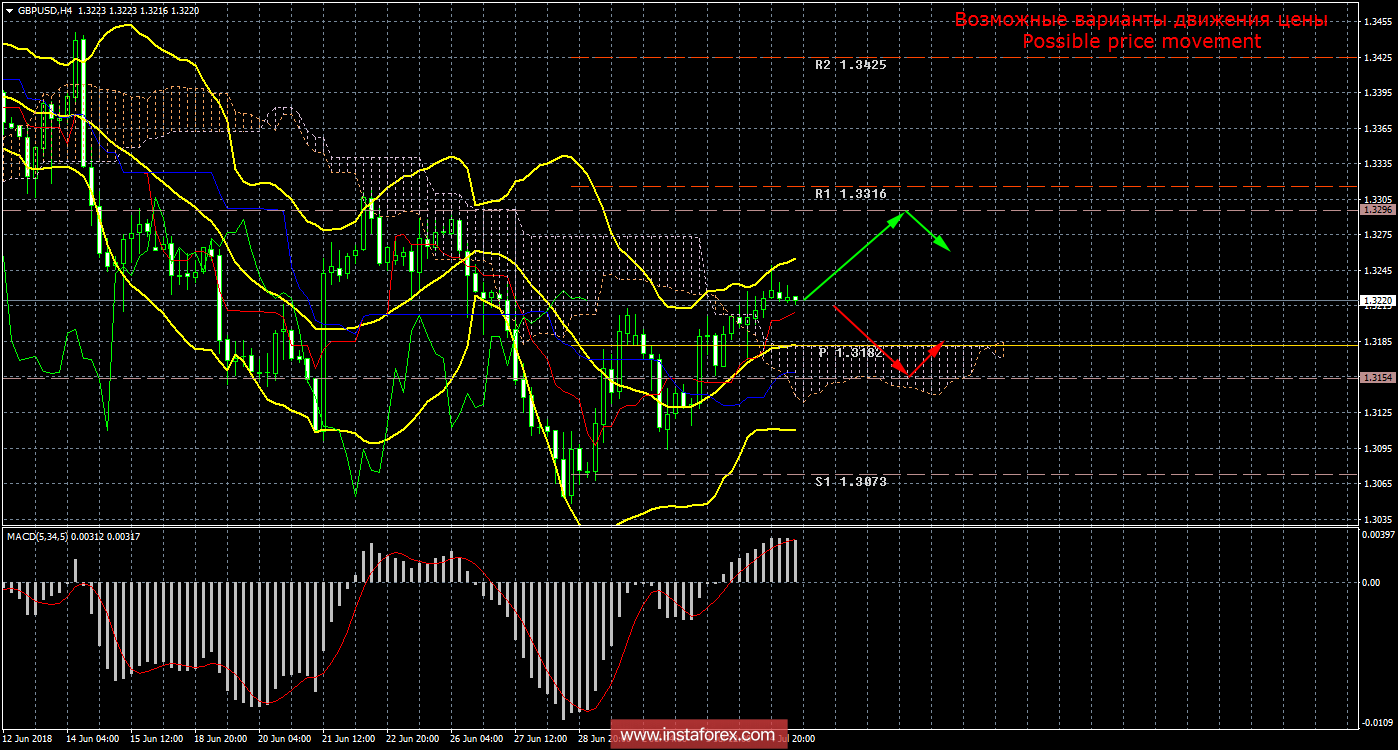

4-часовой таймфрейм

Amplitude of the last 5 days (high-low): 73p - 145p - 114p - 92p - 79p.

The average amplitude for the last 5 days: 100p (110p).

The pound sterling continued to move upward on July 4 by inertia. The index of business activity in the services Markit showed an improvement in the situation, the indicator increased from 54 to 55.1. Little support was given to this report by the British currency, but in a larger measure, the pair continued to move upwards by inertia. The outlook for the British currency still looks hazy due to the huge amount of uncertainties associated with the same Brexit. British industrialists still do not understand when Brexit finishes (although officially the process should be completed in March 2019), how will the final stages of negotiations with the EU for the "transition" period take place, what will be the duration of the "transition" period? All this makes traders in the medium and long-term to avoid the pound side. Trade wars, unleashed by the United States, seem not to concern the United Kingdom, but in the future, they may also affect its interests. Nevertheless, the general demand for the dollar, which arises from time to time, affects the positions of the British currency. Many traders regard Trump's actions as a force and believe that this will be useful to the American economy. And since it is useful for the economy, it means that you need to invest in it. Thus, in general, the markets remain the strong demand for the dollar, which again has a negative impact on the pound. It seems that now only one person manages the currency market - the US president. Tomorrow, he can make a shocking speech and the US currency will collapse. May provoke a new conflict or introduce new trade duties and the dollar will rise. Thus, we continue to closely monitor the performances of Trump and even his messages on social networks, since the main driver of the major currency pairs now is precisely the leader of the States.

Trading recommendations:

The currency pair GBP / USD continues the not too strong upward movement, which allows staying in the longs with a new goal of 1.3296. Turning the MACD indicator down will be a signal to the beginning of the downward correction and the closing of long positions.

Shorts will become relevant intraday if the MACD indicator turns down. The goal, in this case, will be the Kijun-Sen line, and it is recommended to reverse the correction with exceptionally small lots.

In addition to the technical picture, one should also take into account the fundamental data and the time of their release.

Explanations to the illustration:

Ichimoku Indicator:

Tenkan-sen is a red line.

Kijun-sen is a blue line.

Senkou Span A is a light brown dotted line.

Senkou Span B - a light purple dotted line.

Chinkou Span is a green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and histogram with white bars in the indicator window.