EUR / USD

With the release of US employment data on Friday, the price attacked the resistance of the trend line on a daily scale And this morning, a white candle is formed above it. But still, we cannot consider the data as disappointing despite a number of mass media did just because the dollar fell. There were 213 thousand new jobs created outside the agricultural sector in June against the forecast of 195 thousand. The May figure was revised upwards from 223 thousand to 244 thousand. The share of economically active population increased from 62.7% to 62.9% For this, the total unemployment rate formally increased from 3.8% to 4.0%. Also, the "pessimists" appealed to the 0.2% wage increase for the month against the expected 0.3%, but if the forecast was 0.2%, the media would have to tighten very much to come up with an explanation for the speculative price spike, the aim of hunting for middle-class investors. Also note that the US trade balance for May was better than the forecast: -43.1 billion dollars against -43.6 billion and -46.1 billion in April.

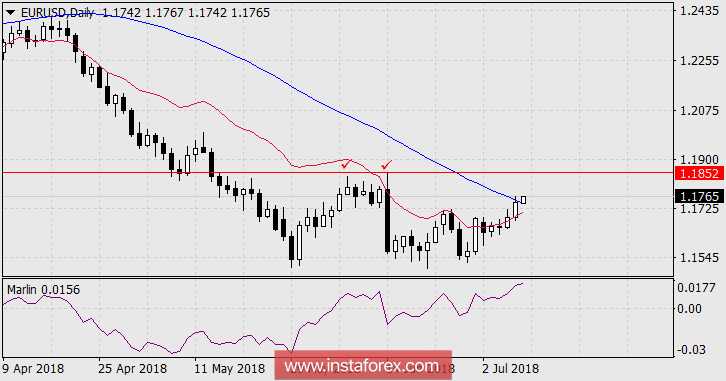

The target for further price growth is the maximum of June 14 at 1.1852.

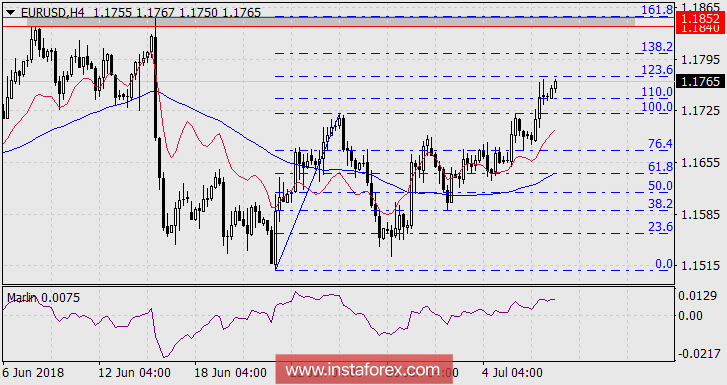

OOn the 4-hour chart, we will slightly clarify the growth target at the range of 1.1840 / 52, and the lower limit is taken from the maximum on June 7. The 1.1852 level also coincides with the Fibonacci retracement level of 161.8%.

* The presented market analysis is informative and does not constitute a guide to the transaction.