Eurozone

Dynamics in the main currency pair due to lack of significant drivers in Europe will be determined by the dollar's response to the marathon in the Congress of the head of the Federal Reserve Powell, the first of the speeches will be held today at 17.00 Moscow time. Markets will change the assessment of the likelihood of a fourth rate hike in the current year, which could lead to EUR / USD volatility.

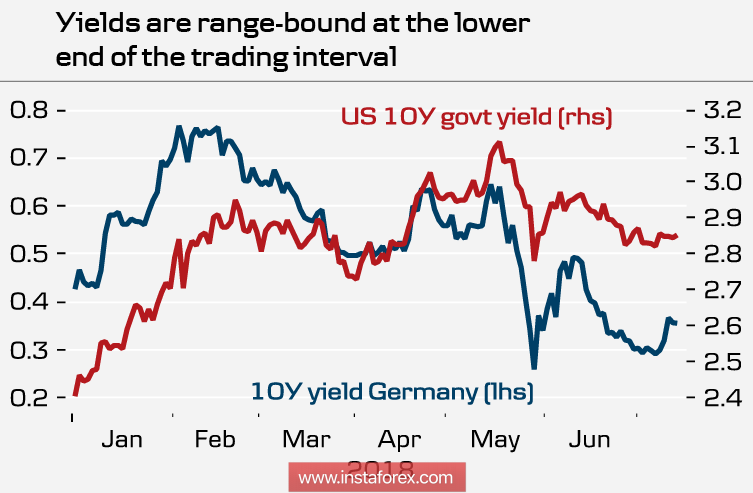

The ECB, apparently, is not interested in tightening monetary policy, since the main inflationary component is energy prices. In case the oil goes into a deep correction, the reasons for the growth rate will be reduced. At the same time, the dynamics of the spread between US and German bonds are quite eloquent, and further inaction will increase the capital outflow from the eurozone.

Euro traded in the range in recent weeks, when the players' attention was focused on the prospects of unfolding a full-fledged trade war between the US and China. We must proceed from the fact that the chances of ending the trade war are decreasing as the election date for Congress approaches, which means that the threat of using the next package of restrictions on the volume of imports equal to 200 billion looks quite real.

As for the EU, the trade talks will begin in a week on July 25, Trump has already outlined a tough stance that is likely to lead to higher duties on cars if the EU does not make concessions.

Before the opening of the European session, EUR / USD has no direction. Trade will continue in the range, which is limited by the levels of 1.1613 ... 1.1791, with a slight gravitation towards the lower border. On Wednesday, the inflation report will be published, the forecasts are moderately negative, it is expected that the prices of prices will decrease due to the correction of energy prices, which may lead to an additional weakening of the euro.

United Kingdom

On July 7, Prime Minister Mai and her cabinet agreed to a "collective" agreement on the upcoming Brexit strategy, which cost the chair at once to two cabinet ministers, May. The UK still wants to sign a free trade agreement with the EU, but the White Paper, published the day before, does not contain any special surprises, and its essence can be expressed in just one phrase - "leave to stay."

Today at 11.00 Moscow time, Mark Carney's speech will take place, a report on the labor market will be published later in 3 months. The key indicator - the growth rate of the average wage - has a negative outlook, which puts some pressure on the pound, since it will jeopardize inflation, and the release for June will be published on Wednesday.

At the moment, the forecast for GBP / USD is neutral, the range is 1.3190 / 3280, the pound will be traded in the range, at the end of the day it is possible to test its lower limit.

Oil and ruble

US Treasury Secretary Steven Mnuchin said on Monday that sanctions are possible for Iran against "exceptions", which immediately led to a drop in quotations by 4%. The next bearish news could not go unnoticed, the oil market starts to search for a balance against the backdrop of growing supplies. Mnuchin intends to discuss this issue at the G20 finance ministers summit at the end of this week, the likelihood of easing for some trading partners is an obvious attempt to create a bonus for negotiations before another escalation of trade wars.

China, in particular, has repeatedly stated that it will not implement sanctions against Iran and intends to impose a 25% import duty on oil from the US as a retaliatory measure.

The 72.00 / 30 range for Brent is the lower limit of the uplink, the consolidation below is able to strengthen the corrective mood, in this case, the potential for a decline is possible to $ 60 / bbl. in the perspective of two months.

The ruble relieves itself more and more from the price of oil, but it can not completely ignore it. In general, the ruble is affected by trends in emerging markets, in particular, the threat of a global slowdown due to the escalation of trade wars. The Ministry of Finance intends to further limit the strengthening of the ruble by buying up the currency, and if oil does not go into deep correction, the ruble will be strengthened in the perspective of 1-3 months. Supports 61.70 and 61.30, they are the goals for the rest of the week.