Lately, all sorts of rumors have an active influence on the dynamics of currency pairs. As a rule, market gossip is not confirmed, and this fact provokes even greater volatility for one or another pair. For example, the talk of "hawkish" intentions of the ECB and the Bank of Japan as a result did not find their confirmation, after which the yen and the euro were under certain pressure. It remains an open question whether this information hype has been artificially injected, or it is only a question of incompetence of journalists. But it is generally not important. Market rumors have been and always will be, influencing the behavior of traders.

So, the Canadian dollar became a hostage of pessimistic rumors that the next NAFTA talks will be held without the participation of Canada. It should be noted right away that this information looks strange and too improbable, considering the previous events, which we will talk about further. But, nevertheless, there is no other explanation for the weakening of the Canadian dollar at the moment, especially as the US dollar index decreases and the oil market grows. The pair USD / CAD pushed off from the mark of 1.3030 and slowly drifts north.

However, the Canadian is unlikely to go far away from the founding of the 30th figure only on the rumors that Canada will not be allowed to negotiate on the NAFTA, which will take place this Thursday. This information was published by an American publication referring to anonymous sources. And even within the framework of this publication, the information is confusing. Some sources say that the Americans asked the Canadians to "skip" the next round of talks, others sound a different version, saying that the Canadian foreign minister simply did not insist on her presence at the upcoming meeting.

However, previous facts disprove these rumors, or, at least, reduce their plausibility to zero. So, at the end of last week, the Mexican Minister of Economy held a press conference following his meeting with the Minister for Foreign Affairs of Canada. First, he said that the negotiations on the revision of the deal were completed "by two-thirds"; secondly, he stressed that the negotiated agreement "was tripartite and would remain a three-way". And a point.

However, it cannot be ruled out that on Thursday, the meeting will indeed take place in a bilateral format (although this is highly unlikely). But the fundamental fact is that both Mexico and Canada insist on a trilateral final deal. Donald Trump, for his part, has yet dimmed his fervor in this direction. Recently, he no longer threatens to withdraw from the deal unilaterally, and with the new president of Mexico, he demonstrates deliberately warm relations. In addition, before the congressional elections in early November, the US president will not take drastic steps with regard to the NAFTA, so the trilateral group has a few more months to come up with a compromise agreement.

In other words, the negotiation process is on its own, and traders have no objective grounds for concern about this. Moreover, the growth of inflation and the increase in the volume of retail sales in Canada allow us to say that the Bank of Canada will not stop on its laurels and may again raise the interest rate by the end of the year. By the way, following the results of the last meeting, the head of the Canadian regulator said that high rates would be needed to keep inflation indicators at the target level. In other words, if inflation continues to show steady growth, the probability of a rate hike in November-December will increase significantly.

The cost of oil also contributes to the strengthening of the Canadian dollar. The barrel of Brent crude oil rebounded from the $ 71.8 mark and is now trading in the area of the 75th figure. Oil traders are under the influence of the continuing tensions in the Middle East. In early August, Washington's sanctions against Iran come into effect. As experts believe, the first round of sanctions will reduce the supply of Iranian "black gold" by 700-750 thousand barrels per day. Against this background, the oil market is growing, supporting commodity currencies, including the Canadian dollar.

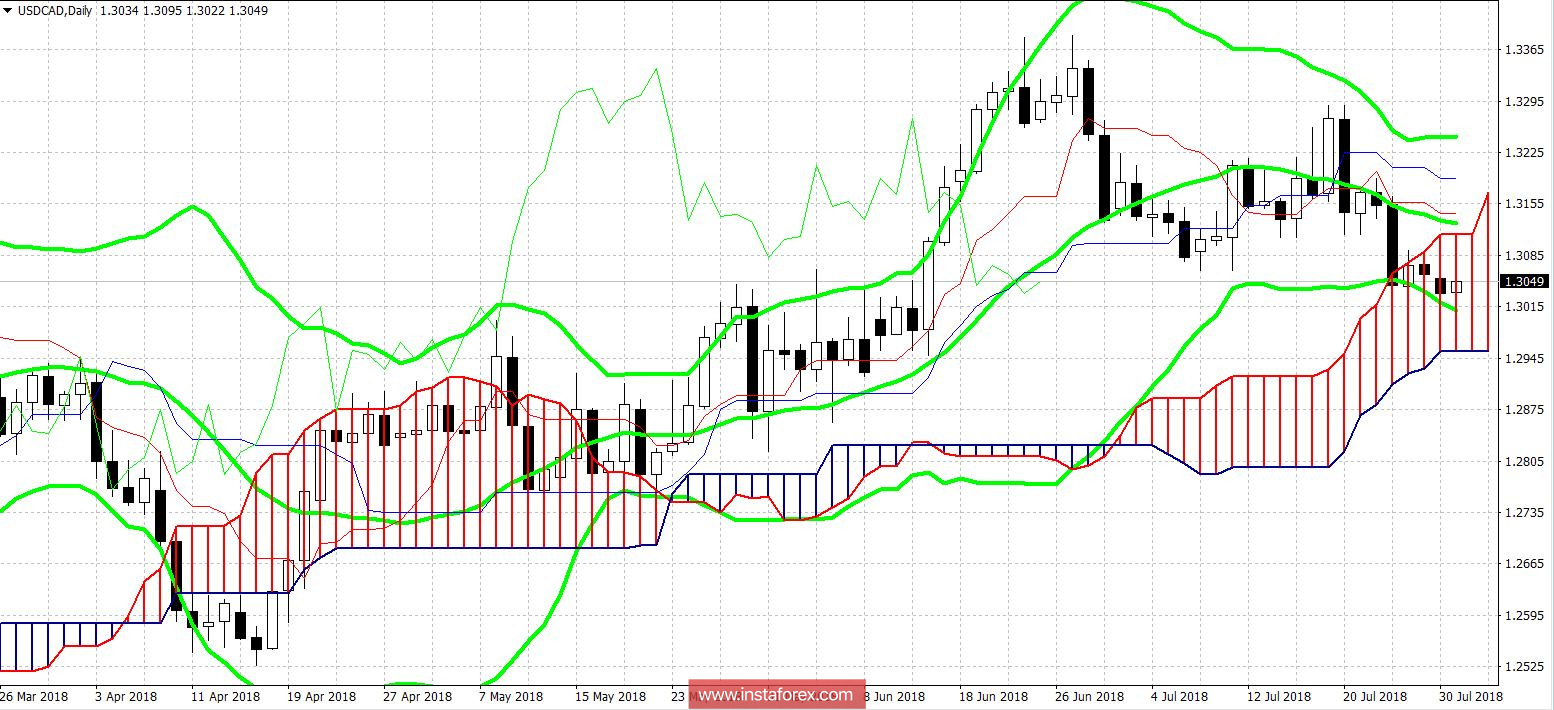

From the technical point of view, the current situation of the pair can be described as a "descending flat". On the daily chart, the pair is between the middle and bottom lines of the Bollinger Bands indicator, as well as below the Tenkan-sen and Kijun-sen lines of the Ichimoku Kinko Hyo indicator, but in the middle of the Kumo cloud. This suggests that the priority for the pair remains for the southern trend, but with possible price retracements within a day. The main goal of the southern movement is a "round" level of 1.3000, overcoming which will open the way to local minimum, into the mid-28th figure area. However, this is quite an ambitious goal, the achievement of which depends on the rhetoric of the Fed members at tomorrow's meeting. If the Fed supports the US currency, the USD / CAD southern targets will have to be postponed.