EUR / USD

Yesterday, the single European currency fell by 31 points. The impulse was set by the job data in the private sector from ADP - the July figure was 219 thousand against the forecast of 186 thousand. The data for the previous month were upwardly revised to 181 thousand from 177 thousand. The dollar strengthening continued after further yields of the worst indicators for Manufacturing PMI and construction costs. Further, the decisions of the FOMC meeting of the Fed were published. The regulator was optimistic about the outlook for the economy.

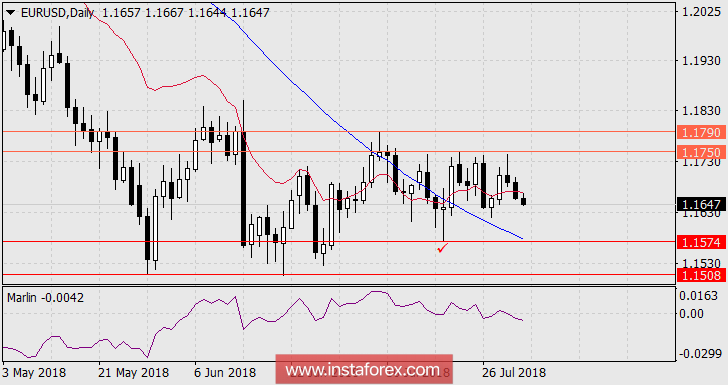

On the H4 chart, all the conditions of the decline are fully met. The price is lower than both indicator lines and directed downwards. While the Marlin oscillator shows a decline in the trend with no signs of a reversal.

* The presented market analysis is informative and does not constitute a guide to the transaction.