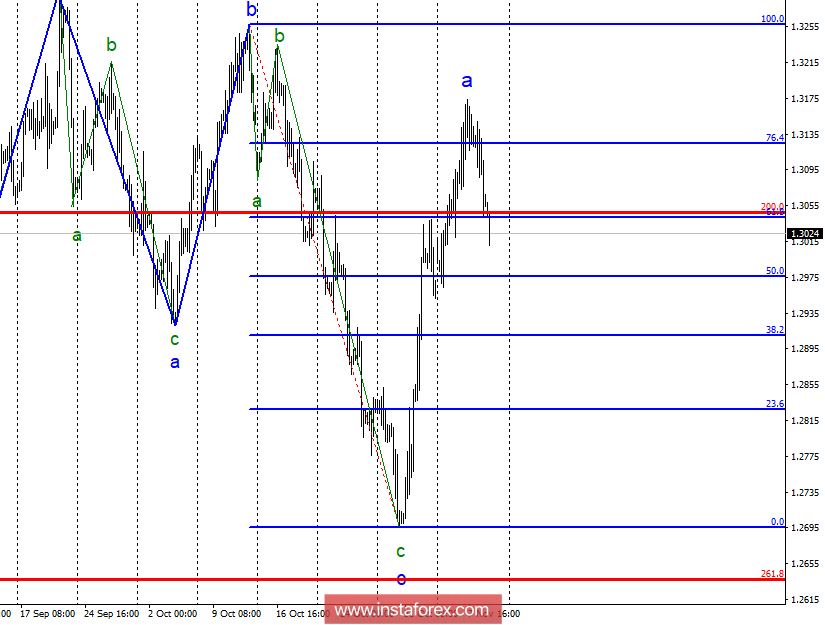

Wave counting analysis:

During the November 8 trading session, the GBP / USD currency pair lost about 60 basis points. Thus, there were grounds to assume the completion of the construction of wave a or 1 of a new upward trend section. If this is true, the decline in quotations will continue to the levels of 50.0% and 38.2% according to Fibonacci. After the completion of the corrective wave, the pair's growth is expected to resume, however, in a situation with the pound sterling, much will depend on the news background and the situation with Brexit.

The objectives for the option with purchases:

1.3124 - 76.4% of Fibonacci

1.3256 - 100.0% of Fibonacci

The objectives for the option with sales:

1.2638 - 261.8% of Fibonacci (senior grid)

General conclusions and trading recommendations:

The currency pair GBP / USD remains in the process of building an upward set of waves. The construction of a corrective wave has now begun, so I do not recommend buying a pair before the completion of this wave. There is a fairly high probability that the instrument will proceed to the construction of a pulsed descending wave, and the entire wave marking of the instrument will again require making adjustments. Therefore, with new purchases, we should be extremely careful.