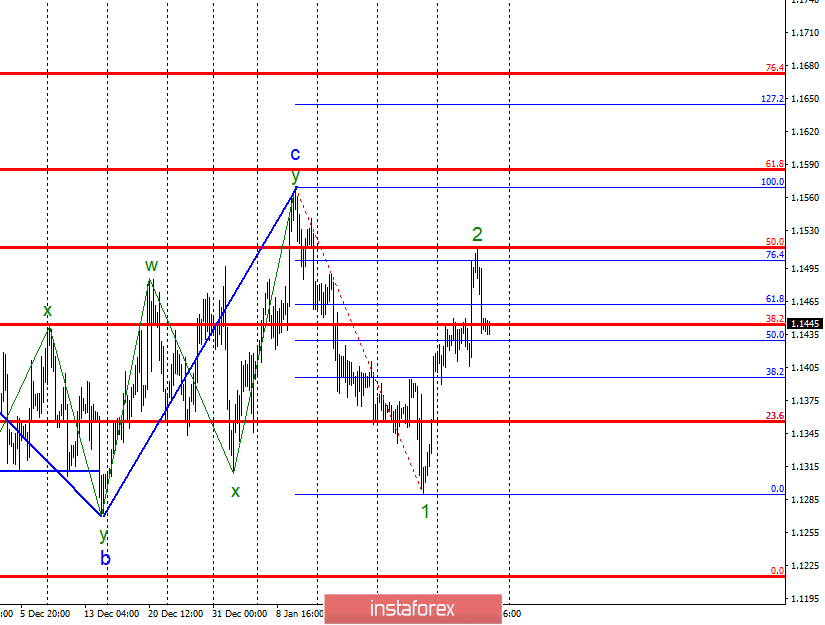

Wave counting analysis:

On Thursday, January 31, trading ended with a 30 bp decline for the EUR / USD pair. Thus, the estimated wave 2 can be completed. If this assumption is true, then the decline of the instrument will continue within wave 3 with targets located about 13 figures and below. Even if the current wave counting is transformed into a three-wave one, the increase in quotations should not be higher than the maximum of wave c, after which, in any case, a descending wave with targets around 13 figures is expected. The unsuccessful attempt to break through the levels of 76.4% and 50.0% according to Fibonacci indirectly indicates the pair's readiness to decline.

Sales targets:

1,1289 - 0.0% Fibonacci

1.1215 - 0.0% Fibonacci

Shopping goals:

1.1502 - 76.4% Fibonacci

1.1569 - 100.0% Fibonacci

General conclusions and trading recommendations:

The pair supposedly completed the construction of the correctional wave 2. Thus, now I expect the tool to continue to decline with targets located near the marks of 1,1289 and 1.1215, which equates to 0.0% and 0.0% Fibonacci. The backup option provides for the complication of the upward wave of January 24, but the probability of this option is now extremely low.