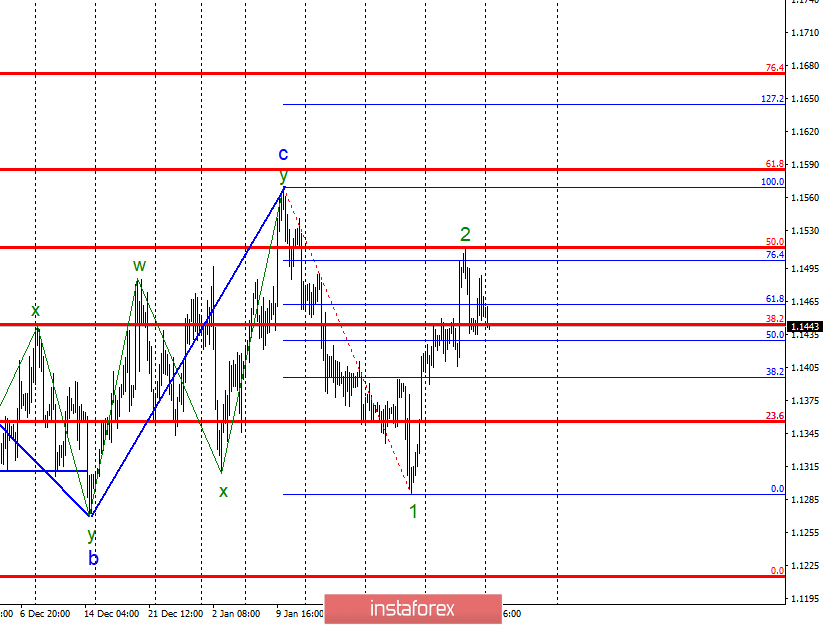

Wave counting analysis:

The trading on Friday, February 1, ended with a 10 bp rise for the EUR / USD pair. Since the maximum of January 31 was not broken, wave 2 is considered to be completed, and I expect the quotes to continue to decline as part of the future wave 3 of the downward trend segment with targets around 13 figures. Still, an alternative option is to build a downward wave but within a three-wave downward structure. The decline below figure 13 level causes some doubts, since this area will be very difficult to pass and you will need a news background, which is a dollar.

Sales targets:

1,1289 - 0.0% Fibonacci

1.1215 - 0.0% Fibonacci

Shopping goals:

1.1502 - 76.4% Fibonacci

1.1569 - 100.0% Fibonacci

General conclusions and trading recommendations:

The pair supposedly completed the construction of the correctional wave 2. Thus, now I recommend selling the instrument with targets located near the marks of 1.1289 and 1.1215, which equates to 0.0% and 0.0% Fibonacci. A successful attempt to break through the level of 50.0% on the older Fibonacci grid will push the conclusion that the instrument is ready for an increase and will require making adjustments to the markup.