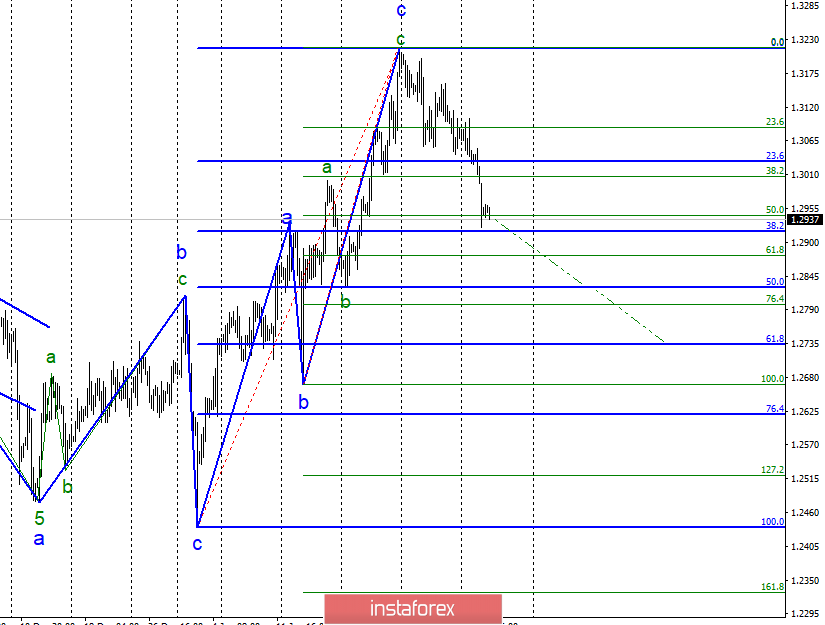

Wave counting analysis:

On February 5, the GBP / USD pair lost 85 bp, so the wave pattern suffered certain changes due to the fact that according to the previous markup, wave 4 went beyond the maximum of wave 1. The entire upward trend segment, taking its beginning on January 3, was transformed in the three wave. Thus, the tool has now moved on to building a downtrend of the trend, which can also be three-wave. Moreover, I expect a general tool decline of at least 26 and 25 figures. Furthermore, the news background is already on the side of the current wave marking now. . On the other hand, there is no final decision on Brexit, how Theresa May's visit to Brussels will end is unknown, and a new parliamentary vote will be held on February 13 This all supports the option of reducing the pair.

Shopping goals:

1.3216 - 0.0% Fibonacci (formal goal)

Sales targets:

1.2827 - 50.0% Fibonacci

1.2734 - 61.8% Fibonacci

General conclusions and trading recommendations:

The wave pattern has suffered adjustments, and the uptrend of the trend now looks complete. Thus, I recommend selling the instrument with targets located near the estimated marks of 1.2827 and 1.2734, which corresponds to 50.0% and 61.8% in Fibonacci. The fall potential of the pound sterling is much greater, especially if the situation on Brexit does not clear up or will shift more and more towards the disordered exit of the United Kingdom from the European Union.