To open long positions on EURUSD, you need:

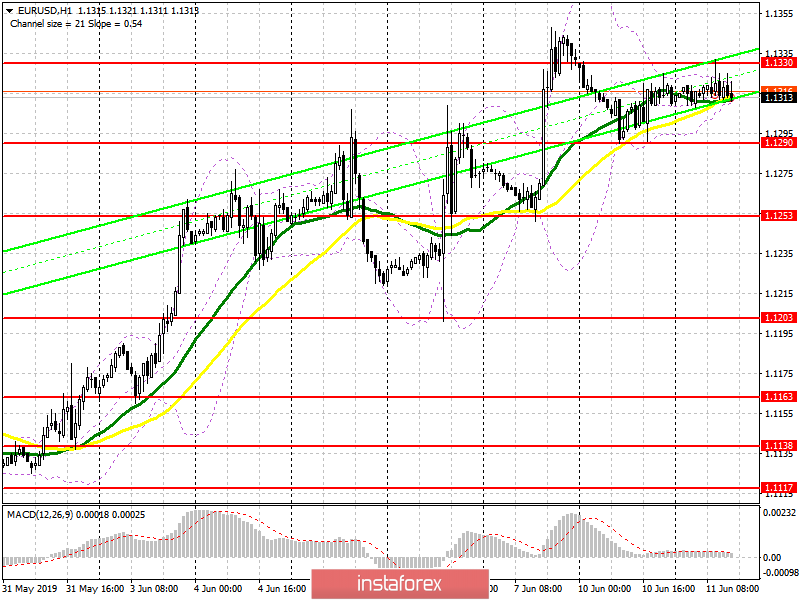

The situation did not change in the morning and the technical picture remained the same. At the moment, the repeated resistance test of 1.1330 can lead to a breakdown, and the main task of the bulls will be to consolidate above 1.1330, which will indicate the continuation of the upward trend with an exit to a maximum of 1.1366 and 1.1392, where I recommend taking the profit. In the scenario of a repeated decline to the support area of 1.1290, it is best to return to long positions on a false breakout, or already on a rebound from the minimum of 1.1253.

To open short positions on EURUSD, you need:

The bears coped with the task and formed a false breakout in the resistance area of 1.1330, but this did not lead to the desired sale of the euro. The main goal is the support of 1.1290, the repeated test of which will necessarily lead to its breakthrough and the descent of EUR/USD to the minimum area of 1.1253, where I recommend taking the profit. In the case of growth in the second half of the day above the resistance of 1.1330, it is best to sell the euro on the rebound from the new monthly high in the area of 1.136 and 1.1392.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates the uncertainty of the market.

Bollinger Bands

Volatility has dropped sharply, which does not give signals to enter the market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20