To open long positions on GBP/USD you need:

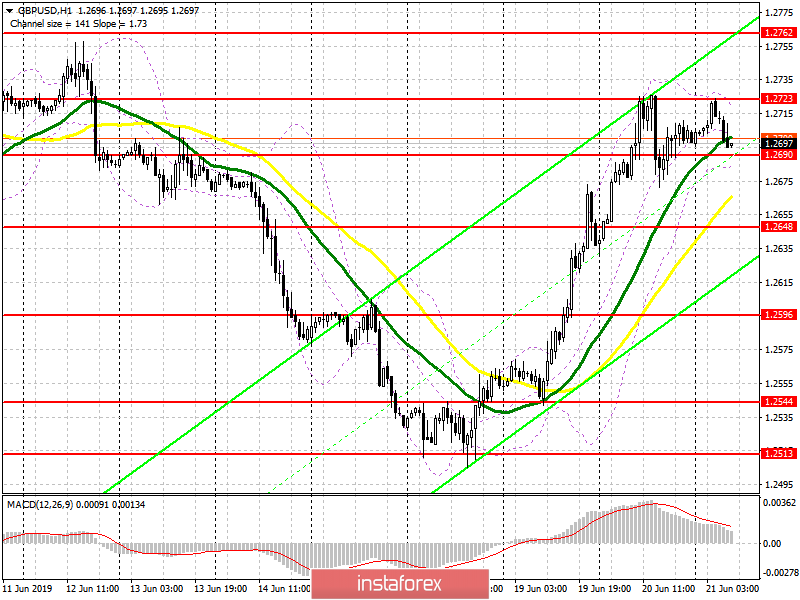

Buyers of the pound are optimistic and continue to open long positions. The best scenario for buying will be when a false breakdown is formed in the first half of the day in the support area of 1.2690, which will lead to the preservation of the upward impulse and a retest of the level of 1.2723, consolidating above which will open the prospect of good movement to the highs of 1.2762 and 1.2786, where I recommend to take profit. With the GBP/USD decline scenario, long positions can be returned to the rebound from the support of 1.2648.

To open short positions on GBP/USD you need:

Sellers of the pound can only expect a decline below 1.2690, which will lead to a larger downward correction to the area of a 1.2648 low, where I recommend taking profits. If demand for GBP/USD remains in the first half of the day, as well as movement along the trend, it is best to consider short positions after updating major resistances of 1.2762 and 1.2786.

Indicator signals:

Moving averages

Trading is above 30 and 50 moving averages, which indicates the bullish nature of the market.

Bollinger bands

In case the pound decreases, support will be provided by the lower boundary of the indicator in the area of 1.2685, while a breakthrough of the upper boundary in the area of 1.2725 will lead to the continuation of the upward trend.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20