The data for the United States, which came out yesterday in the second half of the day, only confirmed the fact that the Fed may seriously consider the option of lowering interest rates in the fall of this year.

Apparently, the only thing that pleased me was that the President of the United States Donald Trump, including the report on the current account deficit of the balance of payments, which shows trade and financial flows between the United States and other countries. According to the US Department of Commerce, the deficit decreased to 130.40 billion US dollar, in the first quarter of this year compared to the deficit of 143.93 billion dollars in the fourth quarter of 2018, according to the revised data.

Economists expected the deficit to shrink to $122.0 billion in the first quarter.

The report also noted that the current account deficit in the balance of payments in the first quarter was 2.5% of the country's real GDP. The main reduction was due to a reduction in the trade deficit in goods.

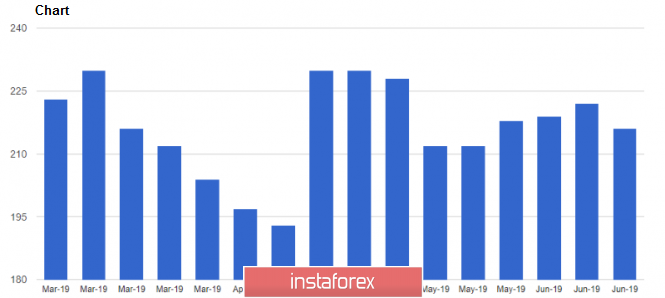

Data from the US Department of Labor Labor Market did not greatly help the US dollar. According to the report, the number of Americans who first applied for unemployment benefits declined last week. Thus, the number of initial claims for unemployment benefits fell by 6,000 in the week from June 9 to June 15, to 216,000. Economists had expected that the number of new claims to be at the level of 220,000. The moving average rose to 218,750 in four weeks.

Overall, the US labor market continues to show strength, even though a slight increase in unemployment is expected in the second half of the year. The report also states that the secondary bids for the week from June 2 to 8 were reduced by 37,000, amounting to 1,662,000.

On the contrary, the report on the index of business activity in the area of responsibility of the Fed-Philadelphia was unpleasant, which fell sharply in June.

According to the data, the general index of business activity dropped immediately to 0.3 points versus 16.6 points in May. A number of sub-indices changed in different directions but the largest drop was noted in the purchasing price index as it fell to 0.6 points in June against 17.5 points in May. This is another sign of a slowdown in US inflation in the 2nd quarter of this year.

As for the technical picture of the EUR/USD pair, further movement will depend on the level of 1.1285. If the bulls manage to hold it in the first half of the day, another attempt to break through the resistance of 1.1310 is not excluded, above of which, there are real prospects for updating the weekly highs in the areas of 1.1340 and 1.1370. A downward correction, which may be formed at the end of the week, will be limited by a large support level of 1.1260.

The British pound remains to bargain in the channel, forming a psychological figure on the continuation of the uptrend. The news that Boris Johnson continues to strengthen his position in the elections for the post of Prime Minister of Great Britain has not yet put serious pressure on the pair since this option was won back by the bears last week.

Let me remind you that yesterday, the former mayor of London Johnson received 157 of the 313 votes of members of parliament representing the Conservative Party.