To open long positions on GBP / USD pair, you need:

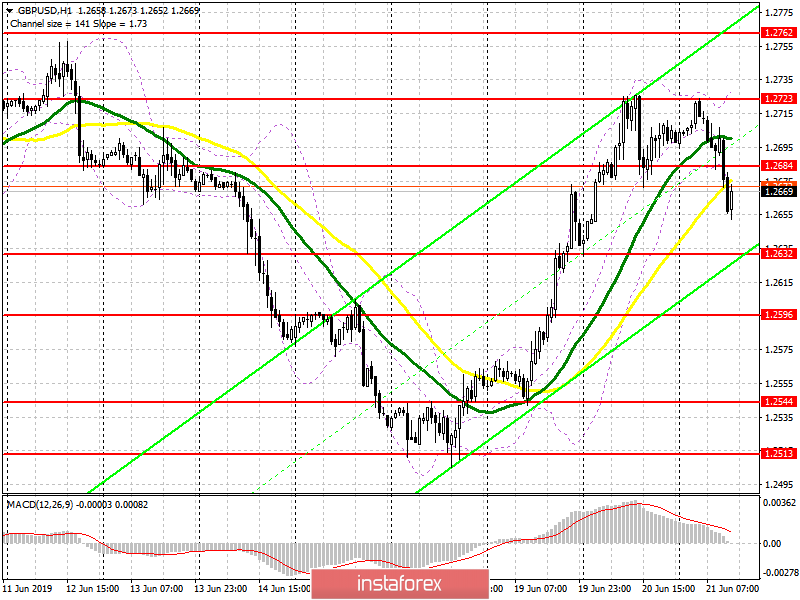

Buyers failed to drag the pound to new weekly highs, which led to the formation of a downward correction in the morning. At the moment, it is best to return to long positions immediately to rebound from large support of 1.2632 or after growth and consolidation above the resistance of 1.2684, which will allow bulls to tighten the GBP/USD pair until the end of the day to a maximum of 1.2723 and retain the upward trend.

To open short positions on GBP / USD pair, you need:

An unsuccessful consolidation and return under the resistance level of 1.2684 will be another signal to open short positions in the pound, which will lead to an update of the minimum of 1.2632, where I recommend taking profits. Under the growth scenario of the pair above 1.2684 (for example, after the release of a weak report on the American economy), it is best to sell the pound to rebound from a local maximum of 1.2723.

Indicator signals:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which indicates the formation of a downward correction.

Bollinger bands

If the pair grows, the average border of the indicator in the area of 1.2695 will act as resistance.

Description of indicators

MA (moving average) 50 days - yellow

MA (moving average) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA 9

Bollinger Bands 20