The US dollar continues to remain under pressure, while the euro and the British pound are trying to continue their upward trend whenever possible. Yesterday's speech by the US President covered various topics, ranging from the head of the Fed and the European Central Bank to relations with China and the whole world. However, the scope, as always, in a million.

Yesterday, Donald Trump criticized the work of the current Fed Chairman Jerome Powell, saying that Powell must lower rates in order to compete with China while adding that he has the right to remove him from office at any time. Trump also said that he will look at how firm the position of the head of the Fed is, and he will assess his work in the near future, which cannot be called good. Somewhere in a jest, and somewhere there is no American President wished that it was Mario Draghi – the head of the ECB – to be the Chairman of the Fed.

Trump once again criticized the fact that Europe is devaluing its currency and is behaving very badly with the United States. Most likely, the US President considers the recent statements of Mario Draghi on the topic of monetary policy, where the President of the ECB announced the likely return of the Central Bank to the bond redemption program, to be a currency devaluation.

Also during his speech, Donald Trump mentioned relations with China, saying that import duties on goods help the US in ways that no one wants to talk about. According to him, almost all countries of the world benefit from the United States.

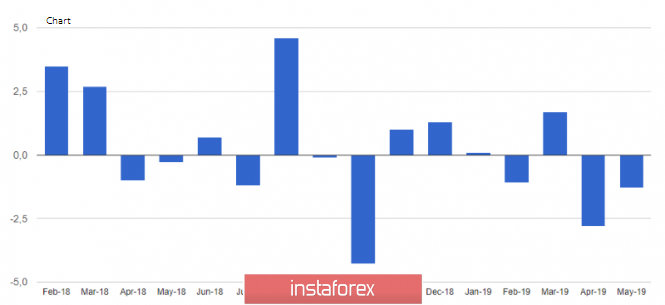

The data that came out yesterday afternoon put pressure on the US dollar, as it demonstrated that the US economy is also starting to slow down. The decline in demand for durable goods is a leading indicator.

According to the report, the demand for durable goods in the United States decreased in May 2019 for the third time in four months. A report from the US Department of Commerce indicated that orders fell by 1.3% compared with the previous month, while economists had expected their decline in May by only 0.3%.

The decrease was due to the reduction of orders for aircraft by 28%, the category of which is very volatile, while excluding the volatile transport category, orders increased by 0.3% compared with the previous month.

Overall, the reduction in orders is directly attributable to the slowdown in global growth and trade tension. Also, the permanent strengthening of the US dollar over the past year has only complicated this problem, which has made American goods less competitive on the world market.

As for the technical picture of the pair EURUSD, the trade continues to be conducted in the side channel. Further short-term downward correction will tend to the levels of 1.1317 and 1.1280, but this requires a breakthrough of the support of 1.1350, which cannot be done throughout the week. Without a good decline in the euro, it is unlikely that there will be a major continuation of the upward trend in the area of highs 1.1430 and 1.1500.