To open long positions on GBP/USD, you need:

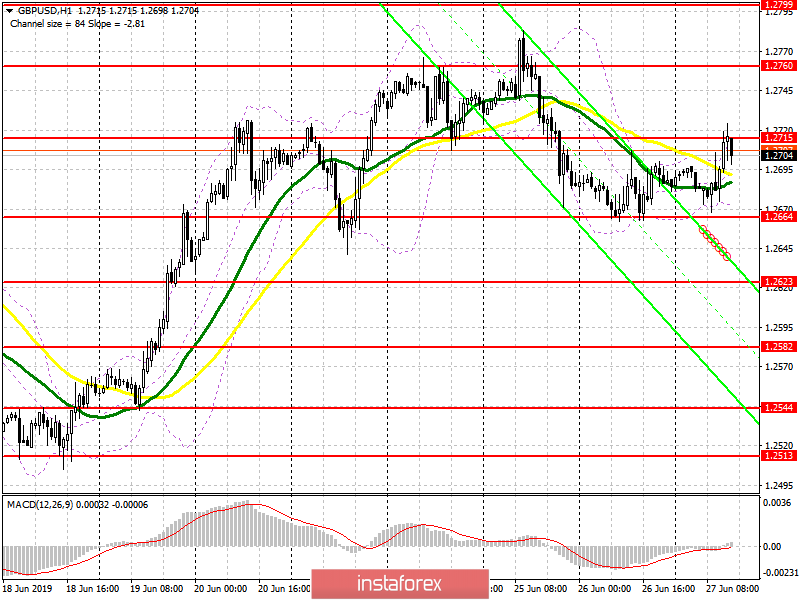

In the first half of the day, buyers of the pound managed to push off the support of 1.2665 and are now trying to break above the middle of the wide side channel 1.2715. If they manage to do this against the background of weak fundamental data on the US, further growth of GBP/USD will lead to an update of the upper limit of the channel in the area of 1.2760, where I recommend taking the profit. In the scenario of the pound decline, the same good level of support will be the area of 1.2664, from which it is possible to open long positions if a false breakout is formed. It is best to buy a pound for a rebound from a new low of 1.2623.

To open short positions on GBP/USD, you need:

Bears will count on a good report on US GDP and on keeping the pair below the resistance of 1.2715. While trading under this range, the probability of continuing the downward correction will remain very high, and the bears' target for the second half of the day will be the level of 1.2664. A break in this range will result in lows of 1.2623 and 1.2582. In the GBP/USD growth scenario above the middle channel of 1.2715, it is best to return to the short positions on the rebound from the resistance of 1.2760.

Indicator signals:

Moving Averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates a market equilibrium.

Bollinger Bands

The breakthrough of the lower boundary of the indicator in the area of 1.2667 will increase the chance of a bearish market.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20