The activity on the world markets has noticeably decreased in anticipation of the outcome of the G20 summit, where the main subject with economic nature will be about trade negotiations between Donald Trump and Xi Jingpin.

Recall that on Thursday, the media reported on the allegedly achieved trade "truce" between the Chinese and the Americans, which caused an upward trend in the US stock market. However, it did not break through that could really cause a rally as has been the case at the beginning of this year, when the American president began to show optimism occasionally about the progress in trade negotiations.

In general, a peculiar dichotomy in assessing the prospects of the negotiation process has recently been noted in the markets. There are still a number of investors who, logically speaking, believe that the normalization of trade relations between Washington and Beijing is simply necessary for the economies of the two countries. They are confident that the continuation of the confrontation will lead to large economic losses not only for the two countries but also for the entire world economy.

Yet, a significant number of skeptics stand out lately, who shows more and more skepticism, believing that Trump will not agree to equal trade relations anyway since his behavior on this topic is clearly combined with his general presidency and cannot be different. This means that he will seek an agreement only on American terms, which is unacceptable for the Chinese side in any case.

In addition to the summit topic, today, we should pay attention to the publication of important for the Fed in terms of monetary policy prospects, data of the basic price index for personal consumption expenditure (RFE), as well as values for income and expenditure of Americans.

According to forecasts, it is expected that the indicator will maintain its previous dynamics for an increase of 1.6% and 0.2% on an annual and monthly basis, respectively. With regard to the dynamics of income and expenses, it is expected that incomes of individuals decreased in growth to 0.3% in May from a value of 0.5% in April. On the contrary, expenses increased by 0.4% compared with an increase of 0.3% in the previous period under review.

Assessing the importance of this data for the Fed, we can assume that if they turn out to be lower than expected, this may stimulate some local weakening of the dollar. At the same time, the release of values in line with forecasts is unlikely to have a noticeable effect on investor sentiment.

Forecast of the day:

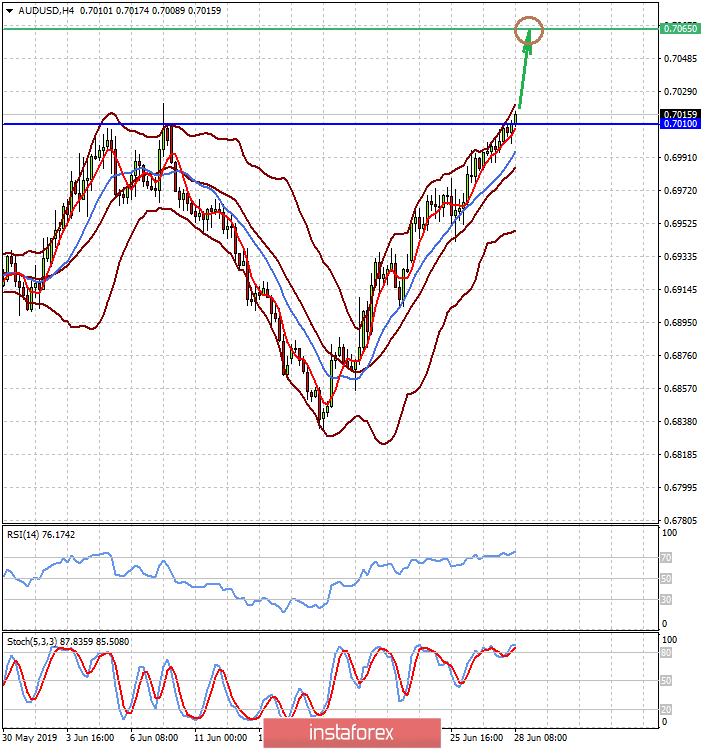

The AUD/USD pair is above the level of 0.7010 on the wave of news about the new "truce" between the United States and China, which supports the rates of commodity currencies of Australia and New Zealand. If data from the US does not show growth above the expected values, the pair will continue with upward momentum and rush to 0.7065.

The NZD/USD pair is testing the level of 0.6700, which is also supported by news about the trading "truce". Weak data from the US can strengthen the expectation of a more active reduction in interest rates of the US Federal Reserve, which will push the pair up to 0.6755.