In just a week and a half, a pair of USD / CAD fell almost 400 points. The June rally was driven by many factors. Good macroeconomic reports, successful negotiations between Trump and Trudeau, the expectation of USMCA ratification, the growth of the oil market and the low profile of the Bank of Canada — all these circumstances pushed the loonie down to semi-annual minimums. Yesterday, the pair tested the 30th figure already (for comparison, at the beginning of June the price was trading in the 1.3510 area), and according to some experts, before the end of the summer, the bears pushed the key support level, "diving" under the mark of 1.30.

Judging by the dynamics of the southern impulse, such a scenario cannot be excluded - especially if the Canadian regulator follows the current line of conduct. According to the head of the Bank of Canada, further actions by the Central Bank will largely depend on the incoming data, so today's release will be of particular importance for the pair. This is the publication of data on the growth of Canadian GDP in April. On a monthly basis, this indicator has demonstrated contradictory dynamics since the beginning of the year - rising to 0.3% in January. In February, it fell into the negative area (-0.2%), whereas in March it was again in the "green zone", reaching 0.5%. In April, experts expect a slight decrease - up to 0.2%. If, contrary to forecasts, the indicator will show further growth, this will give the Canadian an additional impetus for growth. Moreover, in annual terms, experts predict a growth rate of up to 1.5%, after an increase of up to 1.4% in March.

Such figures will indicate a steady growth trend of the Canadian economy, and this fact eliminates investors ' concerns about the easing of monetary policy by the Bank of Canada. And here, it is worth recalling that the overall level of Canadian inflation in May was stronger than the forecast values. One of the key indicators for the Central Bank increased to 2.4%, while the Bank of Canada's guidance was at 2.1%. This allows the regulator to take a patient position in the foreseeable future, and not to follow the US Federal Reserve, which is likely to lower the interest rate in the coming months. Such a correlation keeps the attractiveness of the Canadian dollar.

It is likely that today's release on the growth of the Canadian economy will push a pair of usd / cad to the base of the 30th figure (if, of course, it will be released in the "green zone"). But to overcome the 1.3000 mark, a more weighty reason is needed. Obviously, on the eve of the G20 summit, all other fundamental factors go into the background. By and large, the fate of the US dollar will be decided in Osaka, since the outcome of the summit will allow us to estimate the extent of monetary easing by the US regulator.

Predicting the outcome of the personal talks between the leaders of the United States and China is problematic, especially given Trump's impulsiveness. Expert opinions on this score also differ - according to some analysts, the Chinese will not succumb to the threats of the head of the White House, given the relative closeness of the US presidential election and Trump's preliminary ratings (which is inferior to Democrat Biden about 10%). Other experts say a high probability of a deal: according to them, the text of the agreement is already 90% ready, while the leaders of superpowers need to agree on the most difficult sides of the "truce" (for example, the issue of lifting the sanction from the Chinese telecommunications giant Huawei).

In my opinion, a half-hearted decision will be made in Osaka: the parties will conclude a kind of "non-aggression pact" that will prevent further escalation of the conflict, but will not solve the problem in essence. A similar decision was made at the end of last year, when Trump threatened China with new duties, however, after the talks, he postponed their introduction, and the parties continued the dialogue. The press even appeared a corresponding definition - "fake deal". If Beijing and Washington complete negotiations in Japan in this way, the dollar will remain under pressure, because the duties already introduced earlier will continue to have a negative impact on both the US economy and on the Chinese economy. In other words, a half-hearted solution to the problem will not remove from the agenda the question of reducing the interest rate of the Fed. While the Bank of Canada, in such a scenario, will be able to maintain the status quo, at least within the foreseeable future.

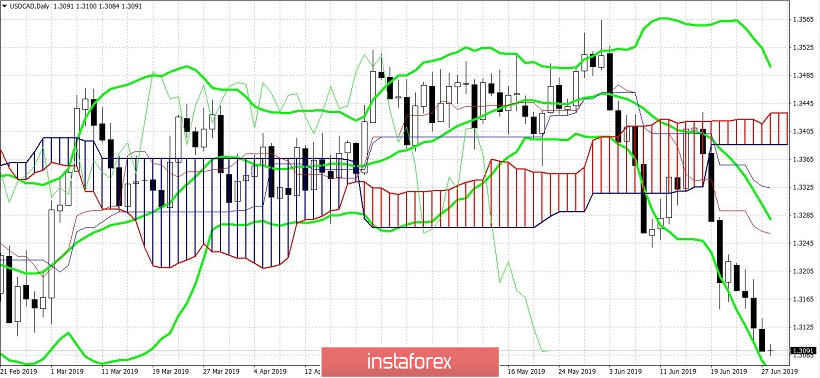

From a technical point of view, the pair shows a pronounced bearish trend, as evidenced by the main trend indicators - Bollinger Bands and Ichimoku Kinko Hyo. Thus, the Ichimoku Kinko Hyo indicator on the daily chart formed its strongest bearish signal, "Parade of Lines," in which all lines of the indicator are above the price chart, thereby showing pressure on the pair. In turn, the price is on the lower line of the Bollinger Bands indicator, which shows a narrowed channel - this is also a strong signal for the downward direction. An additional confirmation of the bearish scenario is the oversoldness of the MACD and Stochastic oscillators. To determine the main goal of the downward movement (resistance level), let's move to the weekly timeframe: here we focus on the lower boundary of the Kumo cloud - this is the price of 1.2950. But the initial resistance level is the psychologically important "round" mark of 1.3000. When it is overcome, reaching the level of 1.2950 will only take a matter of time.