Bitcoin adjusted over the weekend after the closure of a number of long positions, which was quite expected, given the growth that has been observed recently. The downward correction is not finished yet and there are no signals for its reversal.

Over the weekend, an interesting study was published, which in the future will support the demand for cryptocurrencies. The report of the International Monetary Fund indicates that a number of world central banks are planning to issue their own cryptocurrencies. During the survey, the researchers received 96 answers, in which a number of countries reported that they are already testing or preparing for tests of their own national cryptocurrency.

Signal to buy Bitcoin (BTC):

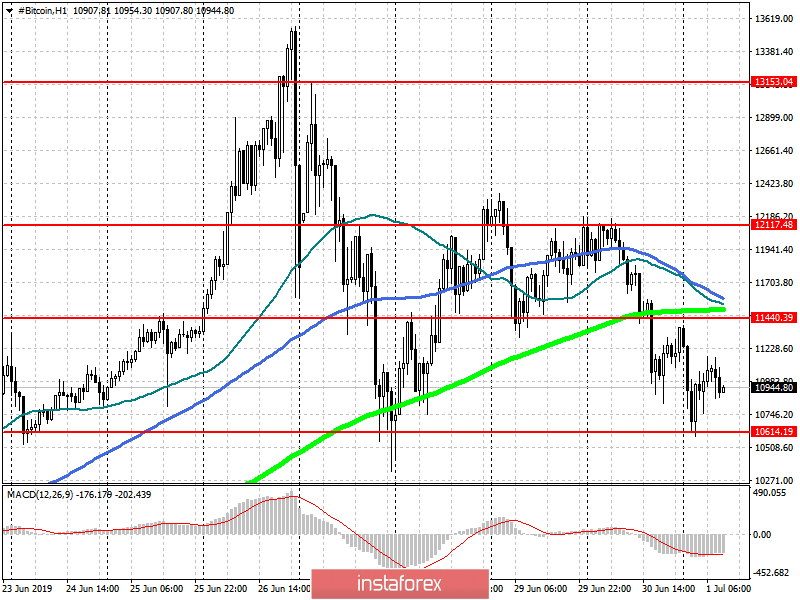

Buyers will try to do everything to keep bitcoin above the support of 10500, but the intermediate goals will be a return to the resistance of 11440, as well as an update to the maximum of 12120, where I recommend fixing the profits. In the case of further downward correction, the minimum in the region of 10200 and 9800 will be relevant for purchases.

Signal to sell Bitcoin (BTC):

The task of bitcoin sellers is to hold the rate below the resistance of 11440, which will maintain the rate of downward correction and lead to a re-test of support for 10600, a breakthrough of which will collapse bitcoin to the area of minimums 10200 and 9800, where I recommend fixing the profit. With growth above the level of 11440, you can sell on a rebound from a larger maximum of 12200.