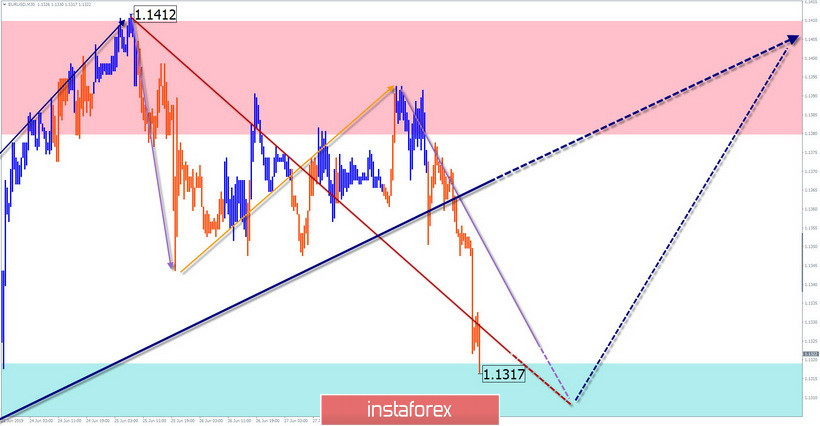

EUR/USD

Price movements in the main euro pair in recent weeks fit into the algorithm of the bullish wave of May 23. Since June 18, the final section (C) has started in the wave, within which the price has been adjusted throughout the past week. The wave structure is fully formed, the price is within the potential reversal zone. But there are no signals for changing course.

Forecast:

During the next trading sessions, the pair is expected to complete its downward trend. The formation of a reversal is expected as part of the settlement support. By the end of the day, the probability of a change in the rate and the price movement of the pair upwards increases.

Recommendations:

Sales of the euro due to the small potential are irrelevant today. In the area of settlement support, it is recommended to monitor the signs of a reversal and the signals of your vehicle, to find the entrance to long positions.

Resistance zone:

- 1.1380/1.1410

Support zone:

- 1.1320/1.1290

GBP/USD

On the chart of the pound, the last, unfinished wave is bearish, from May 2. Since June 18, a bullish wave has been forming towards the main exchange rate, claiming to be a correction. The price reached a strong resistance zone, after which the flat middle part (B) began to develop on the chart in the flat. The wave structure is nearing completion.

Forecast:

Today, it is expected to continue the flat mood of the pair, within the formed flat corridor. Puncture of the lower border of the support zone is unlikely.

Recommendations:

Selling the pound today can be risky. A lot more sensible to reduce. In the area of settlement support, it is recommended to monitor the rate change signal for the purchase of the instrument.

Resistance zone:

- 1.2720/1.2750

Support zone:

- 1.2650/1.2620

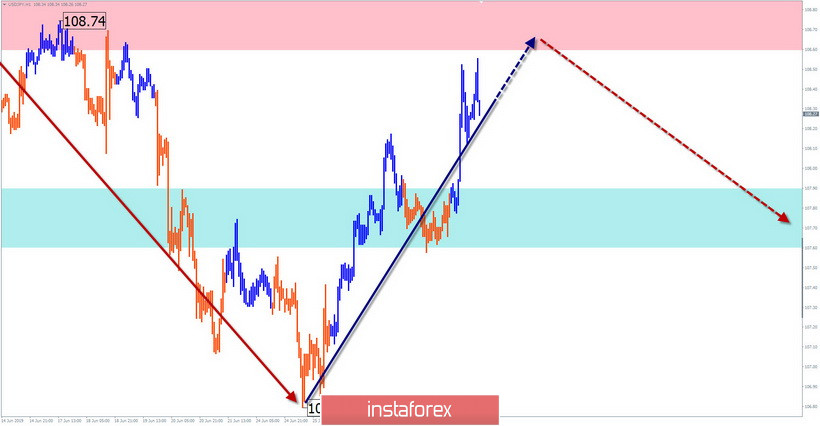

USD/JPY

As a result of its formation, the upward wave of June 21 approached the lower edge of the target zone. The wave level of this section of the chart shows that it corrects the entire trend wave of April 24.

Forecast:

Today, the general flat mood of the yen's price movements is expected. In the morning, an upward vector is more likely. By the end of the mortars, the chance of changing the course of the pair sharply objects.

Recommendations:

When purchasing today, you should keep in mind the expected small potential price rise. In the area of the calculated resistance, you should prepare for a change in the direction of the price rate and look for sell signals.

Resistance zone:

- 108.60/108.90

Support zone:

- 107.90/107.60.

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements.

Note: The wave algorithm does not take into account the duration of tool movements over time.