The introduction of additional tariffs on Chinese imports at the beginning of May brought down the USD/JPY quotes below the psychologically important mark of 110. The 5% duty on Mexican imports pushed them below 108.5 due to migration problems. If Donald Trump and Xi Jinping could not agree on the sidelines of the G20 summit in Osaka, Japan, the analyzed pair had all the prerequisites to go to 105. For now, the "bears" idea would have to be postponed until better times as Washington and Beijing agreed to resume negotiations and went to each other concession. The Middle Kingdom will buy more American agricultural products while the US will loosen the noose around Huawei's neck and delay with the introduction of new tariffs.

Given the fact that the S&P 500 was marked by the best semi-annual dynamics since 1997, the strong position of the yen could cause bewilderment, having strengthened by 17.3% in January-June. Moreover, trade friction, as well as revaluation and increase in sales tax in the fall of the current year risk, caused the economy of the Land of the Rising Sun to plunge into a recession. The main reason for the peak of the USD/JPY pair was the growing expectations of a reduction in the federal funds rate in July. Derivatives market signals that over the next 12 months, it may be reduced by 75 bp. By the end of 2020 and at all by 125 bp, the Fed is worried that trade wars will slow down the US economy. Also, the Fed itself predicts monetary expansion next year.

All of these lead to a decrease in the yield of treasury bonds. The rates on their Japanese counterparts for some time fell to the level of -0.2%. According to JP Morgan, if the yield differential of the debt of the United States and the Land of the Rising Sun collapses to 1%, the USD / JPY pair will be quoted at 100 yen per dollar.

Dynamics of USD / JPY and the differential yield of US bonds and Japan

This situation is quite possible. Hardly anyone is 100% sure that after the meeting between Donald Trump and Xi Jinping. It will begin to improve before our eyes. The White House did not fully disclose the conditions by which China avoided raising tariffs on all its imports, not the fact that the US president will not change his position. The base for fees can be expanded in a month or later, which will return the demand for safe-haven assets.

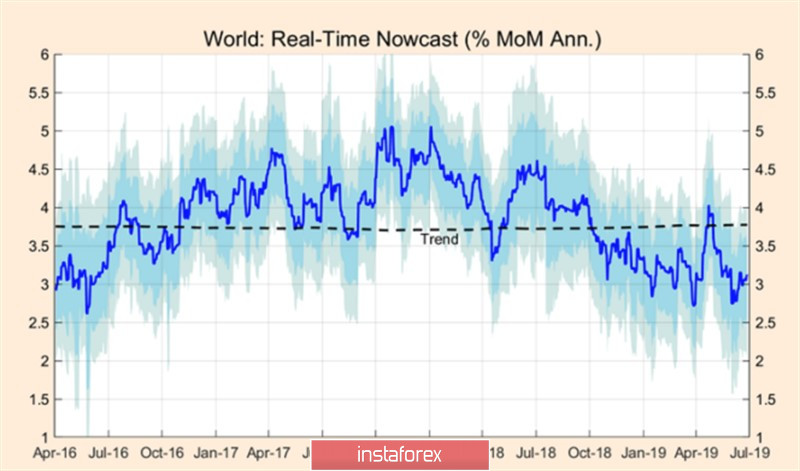

It should be noted that the state of the world economy leaves much to be desired. Judging by business activity, it grows below the trend by 0.7 pp. The Purchasing manager indices in the States have long been pleasing to the eye but the situation is starting to deteriorate. The eurozone and Germany are on the verge of recession, and China is clearly not up to 6-6.5% of GDP growth indicated by the government.

Dynamics of the activity of the world economy

In such circumstances, the release of data on the US labor market for June is particularly relevant. Weak statistics will persuade investors to lower the Fed rate and allow the USD/JPY bears to continue the downward movement.

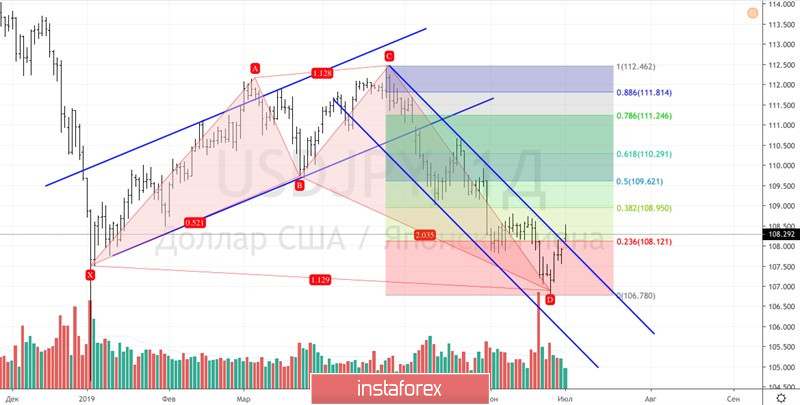

Technically, there is a transformation of the "Shark" pattern in 5-0 on the daily chart of the analyzed pair. Breakouts from the levels of 23.6%, 38.2% and 50% of the CD wave are usually used to form short positions.

USD / JPY daily graph