To open long positions on GBP/USD, you need:

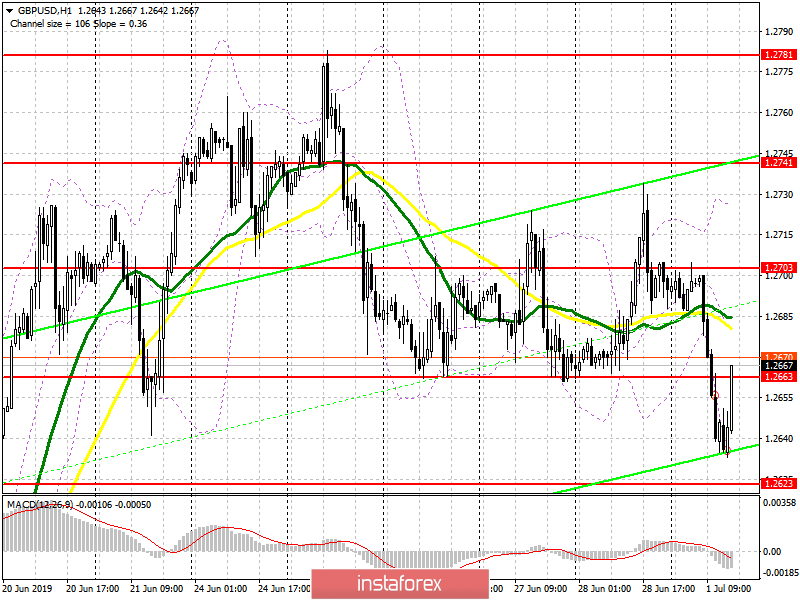

Buyers of the euro missed a large support level of 1.2660 in the first half of the day, but are now trying to return to it. The main task for the second half of the day will be to consolidate above 1.2660, which will lead to a sharp upward momentum of GBP/USD to the maximum area of 1.2703, and to the test of a large resistance of 1.2741, where I recommend taking the profit. In the scenario of a further decline in the pound, it is best to buy a rebound from the new low of 1.2623 and even slightly lower – around 1.2582.

To open short positions on GBP/USD, you need:

Bears will count on a good report of production activity in the US and hold the pair below the resistance of 1.2660, which will retain the downward potential and push the pound into the area of lows of 1.2623 and 1.2582, where I recommend taking the profit. In the scenario of GBP/USD growth in the second half of the day, it is best to return to short positions after the resistance test of 1.2703 or a rebound from the maximum of 1.2741.

Indicator signals:

Moving Averages

Trading is below 30 and 50 moving averages, indicating a further decline in the pound.

Bollinger Bands

The growth of the pair will be limited by the middle of the indicator in the area of 1.2690, or its upper level in the area of 1.2725.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20