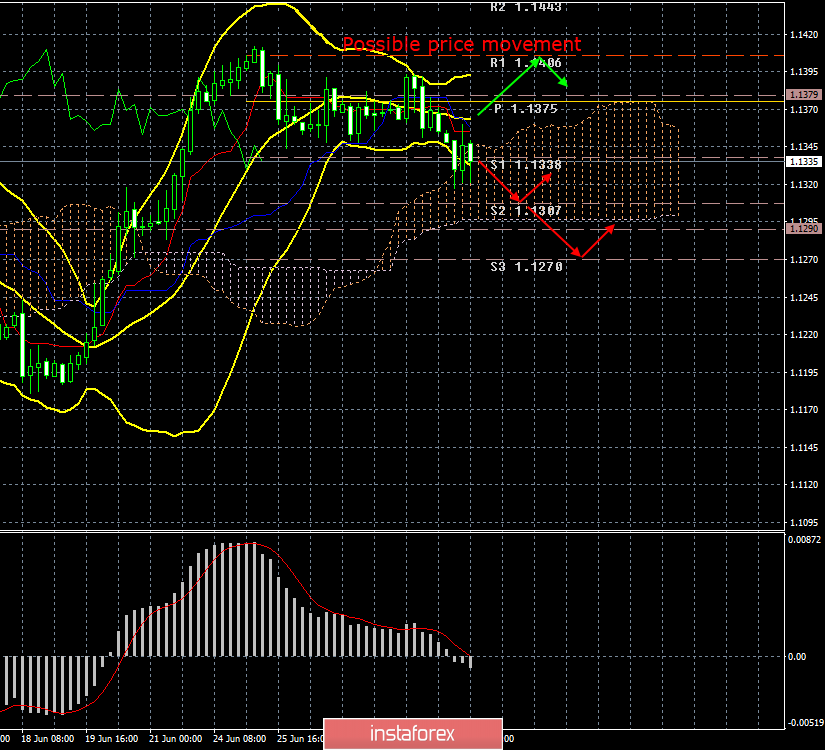

4-hour timeframe

The amplitude of the last 5 days (high-low): 37p - 68p - 43p - 34p - 42p.

Average amplitude for the last 5 days: 45p (55p).

On the first trading day of the week, the European currency resumed its downward movement, which was interpreted as a correction last week. Today, the euro was disappointed by macroeconomic reports on business activity in the European Union and the United States. If in the EU, business activity in the manufacturing sector has deteriorated even more and now stands at only 47.6 (the previous value was 47.8), in the United States, the ISM and Markit business indices exceeded forecast values and an important mark of 50.0 and reached 51.7 and 50.6 respectively. Thus, all three reports of today were in favor of the US currency. We already wrote about the results of the G-20 summit in the morning review, we believe that we cannot simply single out any important results. The fact that negotiations between Beijing and Washington will continue was clear before the summit. We do not know any details of the negotiations or future agreements. Accordingly, a week later Trump can inform in his intrinsic manner that China does not fulfill the terms of the agreement reached at the summit in Japan, and he will also be introducing a new package of import duties from China. From a technical point of view, a new downward trend has already formed, which is still at the very beginning. A new "dead cross" has formed at the Ichimoku indicator, and now the euro/dollar pair should break through the lower boundary of the cloud - the Senkou Span B line to confirm the formation of the down trend. We believe that the US dollar has good chances to increase in price, since the tension between China and the US has slightly subsided, the Fed and Jerome Powell should have calmed down, and talk about the imminent reduction of the key rate would subside.

Trading recommendations:

The EUR/USD pair continues to move down. Thus, it is now recommended to consider selling orders in small lots with targets at 1.1307, 1.1290 and 1.1270 before the MACD indicator reverses to the top.

It is recommended to buy the euro/dollar no earlier than when the price consolidates above the Kijun-sen critical line. Most likely, the bulls will need new fundamental reasons for this.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen - the red line.

Kijun-sen - the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dotted line.

Chikou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD Indicator:

Red line and histogram with white bars in the indicator window.