Oil prices began to gradually decline from their highs in the region of $60 for the WTI brand, after it became known that the OPEC partner countries agreed to cooperate with the cartel, as well as to extend the current transaction to reduce oil production.

As it became known, OPEC, as well as a number of countries that are not members of the cartel, including Russia, have finalized and adopted an agreement on the next extension of the transaction to tighten oil production. According to the conditions, the reduction in the aggregate supply of the coalition of oil-producing countries will be 1.2 million barrels per day until March 31, 2020.

OPEC also concluded a long-term cooperation agreement with Russia, which will help balance the growth of shale oil production in the United States, weakening the cartel's influence on the market.

As the Russian Energy Minister A. Novak stated, the degree of compliance with the agreement in the first half of 2019 was very high, and the actions of OPEC+ significantly reduced market volatility. In his opinion, the decision to extend production cuts will help maintain stability in the oil market and strengthen the position of the cartel.

As for the current technical picture of oil, the level of 60.50 USD is problematic for buyers. However, its breakdown will make it possible to preserve the upward momentum that was observed before the adoption of an agreement on the extension of oil production cuts, which will lead to a test of larger ranges of $64 and $66.

Today, the Australian dollar continued to strengthen its position against the US dollar, despite the statements made by the governor of the RBA. As stated by Philip Lowe, the bank's management is ready to lower interest rates again if necessary, since achieving full employment and target inflation rates are key. In his opinion, a lower unemployment rate is achievable, however, support from the fiscal policy is also desirable for the economy.

Trade wars remain a problem, as well as the prospect of softening the policies of central banks, which will have a negative impact on the country's economy.

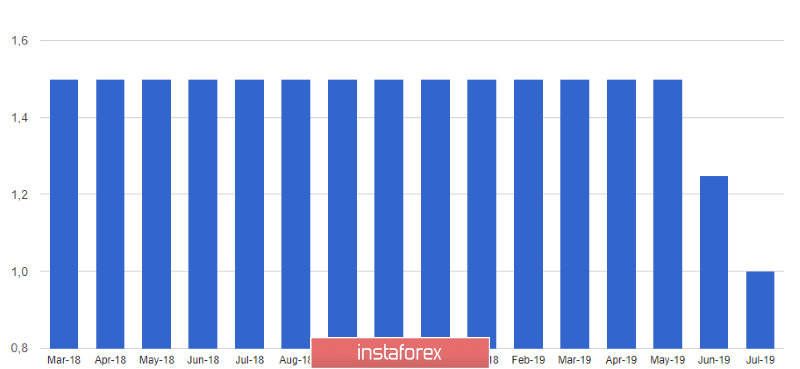

Let me remind you that today the RBA lowered the interest rate from 1.25% to 1.00%.

With regard to the technical picture of the pair AUDUSD, then there is a downward correction, which may continue even if the sellers manage to form the upper boundary of the channel in the resistance area of 0.7000. This will lead to a repeated decrease in the area of weekly lows to the area of 0.6955 and breakdown with the subsequent exit to larger levels of 0.6905 and 0.6850.