While investors around the world are weighing up the results of the G20 summit and trying to understand what is waiting for them in the near foreseeable future, the quotes of "black gold" have collapsed almost 5.0% in Britain and the US.

The meeting of the Chinese and American leaders in the G-20 somewhat reassured investors but did not bring more clarity than expected. In the wake of a slight decrease in tension, stock markets, as well as currency, began to consolidate in anticipation of a new piece of economic data, as well as expectations of meetings of the world Central Bank. Above all, in order to understand the changes in the US monetary policies, negative economic trends in China, Europe and already in the States should be expected.

Meanwhile, as it may seem at first glance, the quotes of crude oil on Tuesday ended in Britain and the United States by almost 5.0%. And all this happened against the backdrop of the achievement of a new agreement by OPEC + to reduce the volume of crude oil production, which is aimed at keeping prices at the highest possible levels.

Hence, it scared the markets. Is it because the extension of the agreement for the next nine months half a year ago would have been perceived with a bang and prices would have crawled upwards?

On the one hand, we believe that the reason for this steady growth in both traditional and shale oil production in the United States, which actually indicates the continuation of the process of conquering a larger and larger share of the oil market in the world by the Americans. In the long run, this can reduce OPEC share to small values. On the other hand, the slowdown in economic growth in China, Europe, and the United States threatens the prospects for a fall in demand for this commodity asset. Oil prices would have fallen long ago to the minimum values of 2016 if they were not artificially restrained by OPEC + policies.

Given the emerging market situation, we believe that price increases will continue to be limited. At best, they will consolidate at about current levels, occasionally growing upward nervously and then falling.

Forecast of the day:

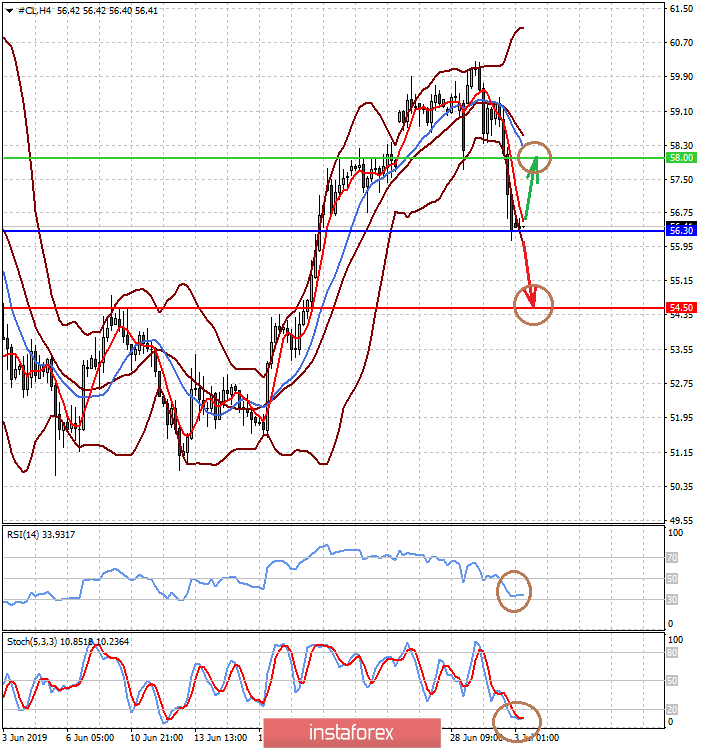

The price of WTI crude oil found support at 56.30 and it can bounce up to 58.00 if the published data on stocks of petroleum and petroleum products in the United States show a decline. But still, the risk of continuing price fall remains if the values show an increase in stocks. In this case, the price will break through support at 56.30 and rush to 54.50.

The EUR/USD pair is consolidating above 1.1280. We expect its decline to continue towards 1.1245 after overcoming the level of 1.1280.