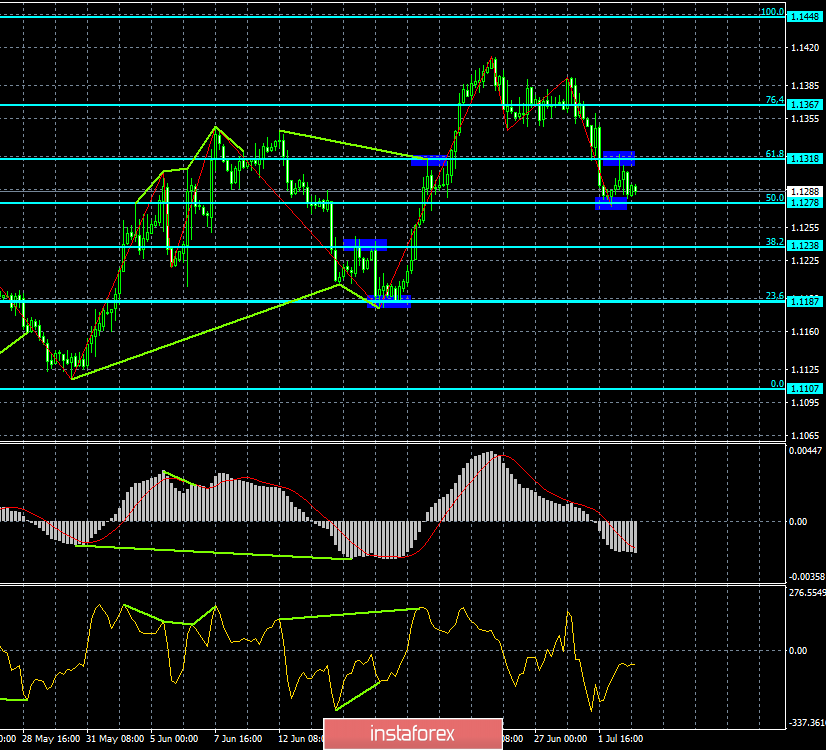

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair fell to the correction level of 50.0% (1.1278), return to the Fibo level of 61.8% (1.1318), and resumed the process of falling. A new rebound from the correction level of 50.0% will again allow traders to count on a reversal in favor of the euro and some growth in the direction of the correction level of 61.8%. Meanwhile, traders will expect and closely monitor several planned reports from the European Union and America today. On Monday, the indices of business activity in the manufacturing sector showed positive dynamics for America, and negative for the EU. Perhaps today, reports on business activity in the service sector and composite will again be in favor of the US currency. Forecasts do not incline us to the expectations of any specific figures – they are fully consistent with the values of May. Only the composite ISM index for the services sector is projected to decline. However, traders will look at matching the forecast to the real value, so any value above 56.1(forecast on the ISM index) will be perceived as positive. The closure of the rate pairs under the Fibo level of 50.0% will increase the probability of further decline towards the next correction levels of 50.0% (1.1278) and 38.2% (1.1238).

The Fibo grid is built on extremums from March 20, 2019, and May 23, 2019.

Forecast for EUR/USD and trading recommendations:

The EUR/USD pair performed a fall towards the correction level of 50.0% (1.1278). I recommend selling the pair with the target of 1.1238, with the stop-loss order above 1.1278, if the closing is performed under the level of 50.0%. I recommend buying the pair with the goal of 1.1318, if a new rebound from the Fibo level of 50.0% and with the stop-loss order under 1.1278.

GBP/USD – 4H.

The GBP/USD pair performed a consolidation under the correction level of 76.4% (1.2661) and continues a systematic decline in the direction of the correction level of 100.0% (1.2437). There are no emerging divergences on the current chart in any indicator. Thus, the technical picture cannot yet prevent the further fall of the pound sterling. Today, traders will be watching out for the index of business activity in the UK. Thus, the future of the two currency pairs will depend entirely on business activity reports. However, for the English currency, it still does not bode well. Even if business activity is higher than traders' expectations, it is unlikely to change the overall picture. The pound sterling will fall further, making breaks not for short periods of time, as the key topic for this currency – Brexit – gives only negative emotions. The pound sterling needs this procedure to be completed as soon as possible, but this can lead to an even greater drop in the pound if the new Prime Minister of the country withdraws it from the European Union by the "No deal" option. In general, the goal of 1.2437 looks quite real for the pound/dollar pair, and only a complete optimist can expect a pound to rise now.

The Fibo grid is built on the extremes of January 3, 2019, and March 13, 2019.

GBP/USD – 1H.

As seen on the hourly chart, the pound/dollar pair performed a reversal in favor of the US dollar and resumed a fall in the direction of the Fibo level of 76.4% (1.2571) after rebounding from the correction level of 50.0% (1.2644). Even two bullish divergences did not help the UK currency. Thus, the next hope of the pound sterling is associated with the level of 76.4% and rebound from it. Closing the quotes below the Fibo level of 76.4% will increase the chances of continuing the fall in the direction of the next correction level of 100.0% (1.2506).

The Fibo grid is based on the extremes of June 18, 2019, and June 25, 2019.

Forecast for GBP/USD and trading recommendations:

The GBP/USD pair closed below the Fibo level of 61.8%. I recommend selling the pair with targets at 1.2571 and 1.2506, with the stop-loss order above the level of 1.2612. I recommend buying the pair with targets at 1.2612 and 1.2644, if it will be rebounded from the Fibo level of 76.4% and with the stop-loss order under 1.2571(hourly chart).