The euro-dollar pair is still trading in the flat, despite the ongoing attacks of EUR/USD bears. But their opponents continue to fight for the 13th figure, despite the rather negative background that has developed for the European currency. However, the US dollar is also weakening throughout the market - the dollar index shows a negative trend, following the yield of 10-year Treasuries, - the figure still fell below the 2-percent mark (currently at the level of 1.958). Both the euro and the dollar are under the yoke of "their" own problems, and this fact forces EUR/USD traders to stagnate in almost the same place on the eve of the weekend in the US and in anticipation of Friday's Nonfarms.

Let's start with the problems of the US currency. White House trade adviser Peter Navarro unexpectedly cooled the heat of dollar bulls, saying that it would take "extra time" to close the deal between China and the United States. According to him, the previous months of negotiations have created only the foundation for the current dialogue, and now the parties need to resolve the most difficult issues. In addition, Navarro said that the United States is not going to exclude Chinese telecommunications company Huawei from its "black list". The Chinese will be allowed to sell only "a small number of processors," that is, low-tech products that do not affect national security. Earlier, Trump's economic adviser Larry Kudlow voiced similar information, although he did not specify that Huawei would remain on the White House's black list. In conclusion, Navarro said that the US Federal Reserve should lower the interest rate, despite the agreement reached to continue the negotiation process between the United States and China.

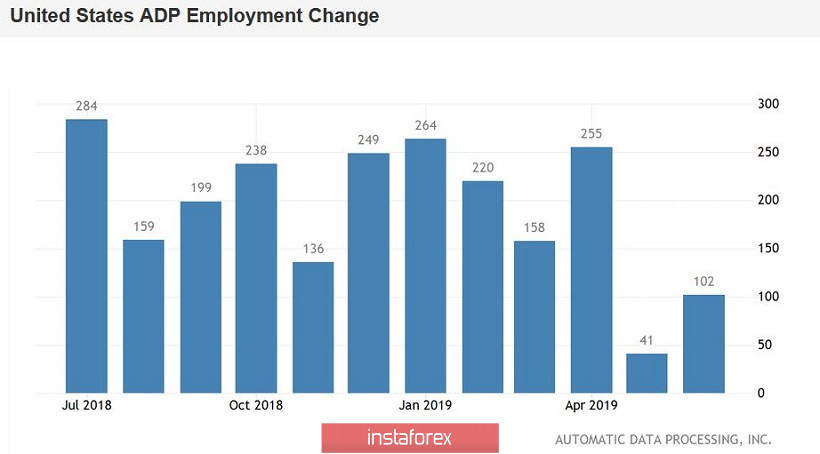

All this suggests that the overall situation has not changed much since last week. The market no longer feared aggressive mitigation of the parameters of the Fed's monetary policy, but this issue is not removed from the agenda. And if Friday's Nonfarms will once again disappoint, then the dollar will lose its conquered positions as quickly as it won them. Today's report from the ADP agency was the first "alarming bell" regarding the prospects for Friday's data. According to published data, the number of employees in June increased by only 102 thousand.

The indicator did not even reach the relatively low forecast level of 140 thousand. The structure of the report suggests that the weakest dynamics was recorded in the small business sector and in the industrial production sector. Regional reports of the Fed confirm this negative trend. In particular, the business index in the manufacturing sector of the Federal Reserve Bank of Richmond showed the strongest decline this year. After February's peak of 19 points it slowed down to three points in June. The structure of the indicator suggests that the component of average employment during the working week and the component of wages have decreased most strongly. A similar situation exists in other regions of the United States. The ADP report is the main guideline before official statistics (Nonfarms), so the dollar could be under even greater pressure on Friday. It is also worth noting that today the extremely weak ISM composite index for the non-production sphere has been released. The index fell to the level of 55.1 in June, updating multi-year lows.

However, by evil irony of fate, the single currency can not take advantage of the dollar's weakness. EUR/USD traders are under the background pressure of rumors about the impending easing of the ECB's monetary policy this fall. Yesterday, information appeared on the market that the European regulator would maintain the status quo at the July meeting, but would prepare traders for the corresponding steps in September.

Additional pressure on the euro was also due to the fact that the position of head of the ECB with a probability of 99.9% will be taken by Christine Lagarde, who will replace Mario Draghi in October. For several weeks, EU leaders agreed on the names of the leaders of key EU institutions. The negotiations were long and difficult: Donald Tusk was even forced to suspend the EU summit to hold separate, bilateral meetings of politicians. Lagarde became a compromise figure in a dispute over who will head the ECB. The Germans actively lobbied for the post of the head of the Bundesbank, Jens Weidmann (who is known for his "hawkish" position), but in the end Berlin got the position of the European Commission chairman (they will be German Defense Minister Ursula von der Leyen), so the ECB will be headed by a French person - Lagarde who was nominated by French President Emmanuel Macron.

It cannot be said that the former finance minister of France and the already ex-head of the IMF holds a "dovish" position regarding the prospects for the ECB's monetary policy. Traders are more concerned about uncertainty. For several months, experts discussed the most likely candidates for this position, "on the shelves" laying out options for possible actions by the European regulator with a particular leader. By the way, the head of the Bank of Finland Erkki Liikanen was considered to be the favorite of the political race for a long time. And when in the end the "dark horse" won the fight, the traders were clearly discouraged. According to a number of experts, Lagarde as a whole will continue the policy of Mario Draghi and largely rely on the decisions/advice of ECB Chief Economist Philip Lane, who, in turn, is an advocate of soft monetary policy (in particular, additional incentives). That is why the candidacy of Lagarde did not cause a general approval from the EUR/USD bulls: personnel changes in the ECB camp do not promise a single currency anything good.

Thus, the controversial fundamental background does not make it possible for bears to continue the EUR/USD's downward trend, and the bulls in developing a more or less large-scale correction. With a high degree of probability, this situation will continue until the release of Friday's Nonfarms. From a technical point of view, the situation has not changed either. Sellers need to gain a foothold under the mark of 1.1280 in order to get to the next support level of 1.1170 (the bottom line of the Bollinger Bands indicator on the daily chart, which coincides with the bottom of the Kumo cloud). The resistance level is the price of 1.1340 - this is the Tenkan-sen line on the daily chart.