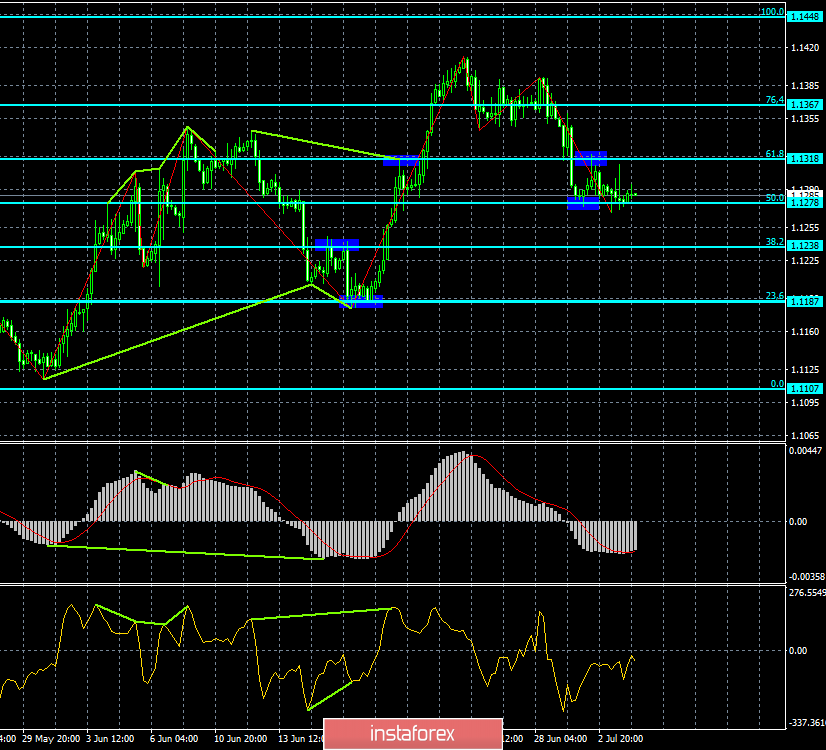

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair fell to the correction level of 50.0% (1.1278). New release of quotations from this Fibo level works in favor of the European currency and some growth towards the correction level of 61.8% (1.1318). On the eve, the European Union unexpectedly pleased with the increased business activity in the service sector, while in the US, on the contrary, business activity in the service sector decreased, according to ISM. But according to Markit – also increased. Such data confused traders more than answered the question, the deterioration or improvement of business activity recorded in June in America and Europe. Probably, the answer to this question has not been found, which led to low activity in yesterday's trading. Today, the situation with activity will probably not be better, as in America today is Independence Day, respectively, all stock, trading and other platforms will be closed. Accordingly, the hope is only for European traders, but they probably also will not force events, especially since the news calendar today is almost empty. Only on retail sales in the European Union can pay attention. At the moment, the Fibo level of 50.0% acts as an obstacle to the continuation of the fall of the euro. Closing the pair's rate below it will work in favor of a further fall in the direction of the correction level of 38.2% (1.1238).

The Fibo grid is built on extremums from March 20, 2019, and May 23, 2019.

Forecast for EUR/USD and trading recommendations:

The EUR/USD pair performed a fall towards the correction level of 50.0% (1.1278). I recommend selling the pair with the target of 1.1238, with the stop-loss order above 1.1278, if the closing is performed under the level of 50.0%. I recommend buying the pair with the goal of 1.1318 if a new rebound from the Fibo level of 50.0% and with the stop-loss order under the level of 1.1278.

GBP/USD – 4H.

The GBP/USD pair performed a consolidation under the correction level of 76.4% (1.2661) and continues a systematic decline in the direction of the Fibo level of 100.0% (1.2437). The current week for the English currency did not start in the best way. Business activity in the manufacturing sector fell to 48.0, in the construction sector – to 43.1, in the service sector – to 50.1, composite index – to 49.7. All four indices fell on June, 3 out of 4 fell below 50.0, the level below which it is believed that the situation in the sphere is deteriorating. There is no new information on Brexit and the election of a new Prime Minister. Thus, it turns out that traders have no choice but to continue to sell the pound sterling. Today, there will be nothing to please traders. The UK news calendar does not contain any interesting data. But British officials continue to "please" the public with statements about the assessment of the cost of leaving the European Union on the "hard" option. Finance Minister Hammond said that such a "pleasure" can cost the country 114 billion dollars. According to Hammond, these figures will have to be taken into account in future taxes and expenses. Thus, after the Brexit, the economic situation in Britain will improve for a long time.

The Fibo grid is built on the extremes of January 3, 2019, and March 13, 2019.

GBP/USD – 1H.

As seen on the hourly chart, the pound/dollar pair fell to the Fibo level of 76.4% (1.2571) and rebounded from it. Fixing quotes below the correction level of 76.4% will work in favor of a further fall in the direction of the next Fibo level of 100.0% (1.2506). Today, the divergence is not observed in any indicator.

The Fibo grid is based on the extremes of June 18, 2019, and June 25, 2019.

Forecast for GBP/USD and trading recommendations:

The GBP/USD pair performed a fall towards the Fibo level of 61.8%. I recommend selling the pair with the target of 1.2506, with the stop-loss order above the level of 1.2571, if the closing is performed under the level of 76.4%. I recommend buying the pair with the goals of 1.2612 and 1.2644, if the rebound from the Fibo level of 76.4% is executed, and with the stop-loss order under the level of 1.2571(hour chart).