Despite the versatile fundamental statistics for the United States, the EURUSD pair remains to trade in the side channel. Most likely, the situation will not change today, as many markets are closed due to Independence Day in the United States.

The labor market data, especially the ADP report, put slight pressure on the US dollar in the afternoon.

According to a report by the US Department of Labor, the number of initial claims for unemployment benefits declined by 8,000 in the week from June 23 to June 29, to 221,000. Economists expected the number of initial claims to be 225,000. There is nothing unusual in the new data.

But the number of jobs in the US private sector increased in June, but the growth turned out to be worse than economists' forecasts, which affected the dollar exchange rate.

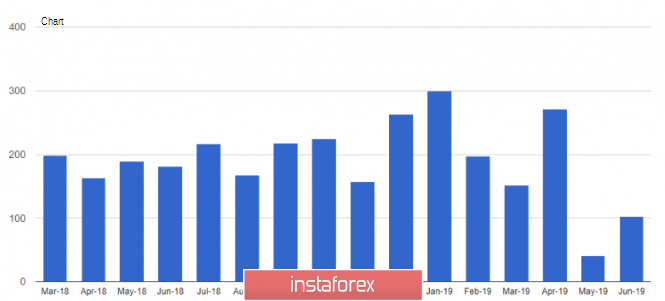

According to the ADP report, the number of jobs in the US private sector increased by only 102,000 in June, as the problems with hiring new employees are still observed by small businesses. The large business remains successful, while small business is more difficult to compete in a full labor market. In large businesses, 65,000 jobs were created, as well as on average. Economists had expected the number of jobs to grow by 135,000.

Trade conflicts and differences between the United States and the rest of the world once again led to a growing trade deficit. High spending contributed to a significant monthly increase in imports, while exports showed more moderate growth.

According to the data, the lack of foreign trade in goods and services in the United States in May 2019 increased by 8.4% compared with the previous month and amounted to $55.52 billion in May. Economists had forecast a deficit of $54.4 billion in May.

Reducing orders for manufactured goods in the United States will have a negative impact on the economy in the 2nd quarter of this year. According to the report of the Ministry of Commerce, orders for industrial products decreased by 0.7% compared with the previous month and amounted to 493.57 billion US dollars. The data fully coincided with the forecast of economists. Without transport, orders in May rose by 0.1% compared with the previous month. Given the general slowdown in global economic growth and trade conflicts, it is not surprising that even in the USA there are problems in the manufacturing sector.

The decline in activity in the US services sector in June led to a temporary weakening of the US dollar position against a number of world currencies. Despite this, the service sector continues to maintain high growth rates.

According to the report of the Institute for Supply Management, the purchasing managers' index for the non-production sphere fell in June to 55.1 points from 56.9 points in May. Economists had expected the index to be 55.8 points in June. Let me remind you that values above 50 indicate an increase in activity.

As for the technical picture of the EURUSD pair, the bears did not manage to break through the support level of 1.1275 yesterday, and therefore the entire emphasis remains precisely at this level. Only a breakdown of the range of 1.1275 will lead to a larger downward bearish impulse paired with an output of 1.1240 and 1.1200 lows. Under the scenario of an upward correction, large resistance is seen in the region of the maximum of 1.1340.