4-hour timeframe

The amplitude of the last 5 days (high-low): 34p - 42p - 90p - 47p - 44p.

Average amplitude for the last 5 days: 51p (51p).

As we expected in the morning, nothing special stood out today, during the fourth of July, having the status of a semi-weekend since Independence Day is being celebrated in the US. Traders decided not to risk it in vain, since tomorrow important macroeconomic reports will be published in the US anyway, after which certain conclusions will be made. In addition, a certain part of traders are generally out of the market today. All this translates into very weak volatility in the euro/dollar pair and frankly a sideways movement. But nothing can be done with this, and we expected it in the morning. The only more or less significant report today - retail sales in the eurozone - as you might guess, turned out to be worse than expected. But since its degree of significance is rather low, there was no particular reaction to it. But tomorrow's NonFarm Payrolls report has a high value amid talk of a possible reduction in the Fed's key rate. If the number of new jobs created outside the agricultural sector turns out to be lower than the forecast (164,000), this will be another reason for the Fed to lower the key rate, if not in July, then in September. By itself, the weakness of this report can also cause short-term sales of US currency. It seems that the EU and the US are competing in the last month, as to whose macroeconomic statistics will be worse. The ECB is also thinking about a rate cut, so the question is which of the two regulators will take this dovish step first. If the ECB comes first then it could end very badly for the euro currency. The euro has just managed to move away from annual lows, and the bulls are hoping for support of the currency pair by the Fed (which can mitigate the monetary policy of the first) and the United States, who cannot agree on a trade agreement with China.

Trading recommendations:

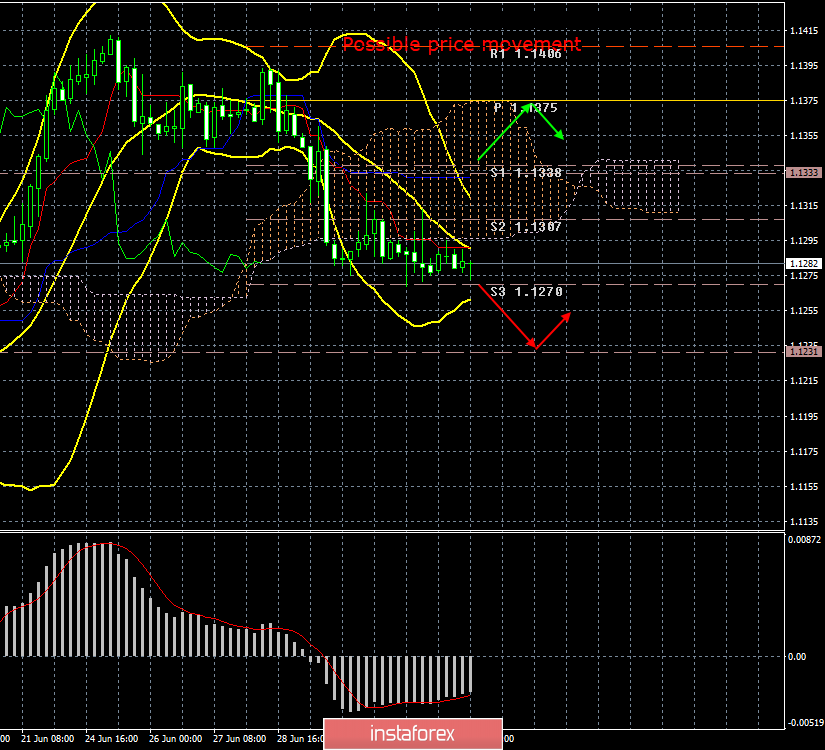

The EUR/USD pair, one might say, continues the correction, since there is no downward movement for the second consecutive day. Thus, it is recommended that you wait for its completion and resume selling the euro with targets of 1,1270 and 1,1231.

It is recommended to buy the euro/dollar pair not earlier than when the price consolidates above the Kijun-sen line. However, this will require a strong fundamental basis for the bulls.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen - the red line.

Kijun-sen - the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dotted line.

Chikou Span - green line.

Bollinger Bands indicator:

3 yellow lines.

MACD Indicator:

Red line and histogram with white bars in the indicator window.