EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair consolidated under the correction level of 38.2% (1.1238), after the US labor market report was much better than expected to see the Forex market. Thus, the process of falling quotations can be continued on July 8 in the direction of the next correction level of 23.6% (1.1187). In addition to the report on Nonfarm Payrolls, on Friday, there were also reports on unemployment and wage changes. Although they were not as optimistic as the labor market, this did not prevent traders from actively buying the US currency. On Monday, traders, unfortunately, do not expect anything interesting. The calendar of economic events is empty, so the day receives the status of a half-exit, or correctional. Today, there is a great opportunity for the euro to grow slightly, as the desire of traders to buy further US currency may be slightly reduced. There are no emerging divergences today. The rebound of the pair from the Fibo level of 38.2% will work in favor of the dollar and the resumption of the fall. The future of the US currency now depends on the Fed and its mood. Tomorrow, the market will be able to find out the approximate mood of Jerome Powell, as his speech will be held in Congress.

The Fibo grid is built on extremums from March 20, 2019, and May 23, 2019.

Forecast for EUR/USD and trading recommendations:

The EUR/USD pair performed a consolidation below the correction level of 38.2% (1.1238). I recommend selling the pair with target at 1.1187, with the stop-loss order above the level of 1.1238. I recommend buying the pair with the target at 1.1278, if the closing above the Fibo level is 38.2% and with the stop-loss order below the level of 1.1238.

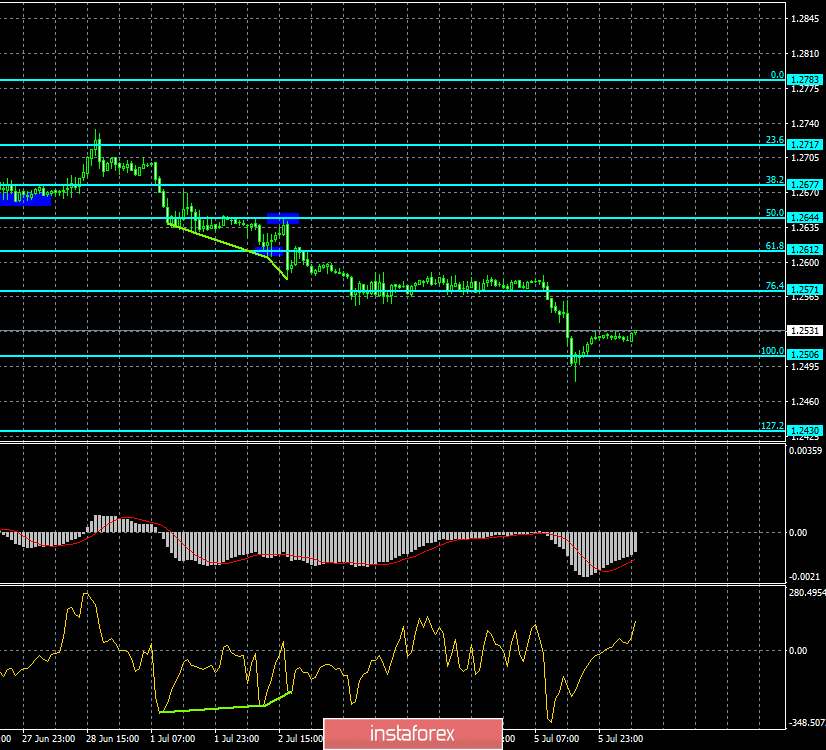

GBP/USD – 4H.

The GBP/USD pair, after fixing under the correction level of 76.4% (1.2661), continues the process of falling in the direction of the Fibo level of 100.0% (1.2437). The news continues to contribute to the fall of the British currency. For example, last week, there were several speeches by Boris Johnson, who continues to assure the media and the public of the need for a tough Brexit scenario on time, that is, October 31. Opponents of hard Brexit remains abound. For example, the Labor Party, the Minister of Finance of Great Britain, and the head of the Bank of England. The main thesis against the hard Brexit is the lack of money in the budget to cover the negative effect, the unresolved issue on the Northern Ireland border. Thus, it can hardly be said that the fate of Brexit has already been decided. At the end of last week, the next blow to the pound sterling was dealt by America, as a strong report on the labor market caused the purchase of the dollar, and the pound sterling, respectively, sank again. Well, bulls have shown their inability to maintain demand for the pound over a long period of time and without the support of weak US economic reports. The closing of the pound/dollar pair under the Fibo level of 100.0% will increase the probability of falling in the direction of the next correction level of 127.2% (1.2185).

The Fibo grid is built on the extremes of January 3, 2019, and March 13, 2019.

GBP/USD – 1H.

As seen on the hourly chart, the pound/dollar pair performed a consolidation above the correction level of 100.0% (1.2506), which allows traders to count on some growth in the direction of the Fibo level of 76.4% (1.2571). There are no emerging divergences on the current chart. The closing of the pair under the correction level of 100.0% will work in favor of the US currency and the resumption of the fall in the direction of the correction level of 127.2% (1.2430).

The Fibo grid is based on the extremes of June 18, 2019, and June 25, 2019.

Forecast for GBP/USD and trading recommendations:

The currency pair GBP/USD closed above the Fibo level of 100.0%. I recommend buying the pair with the target at 1.2571, with stop loss order below the level of 1.2506. I recommend selling the pair with the target of 1.2430, if the consolidation is performed under the Fibo level of 100.0% and with the stop-loss order above the level of 1.2506 (hour chart).