The US dollar kept the momentum for further growth after yesterday's data, which pointed to the strengthening of inflation expectations, as well as the growth of lending in the US.

Today, all the attention will be drawn to the speech of Fed Chairman Jerome Powell, on which, apparently, the further direction in the EURUSD pair will depend. If Powell talks about recent data on the US labor market, it will support the dollar, as in parallel, the head of the Fed may hint at a delay in lowering interest rates until a clearer fundamental picture is obtained. If the Fed Manager continues to adhere to the scenario of possible changes in the conditions of monetary policy towards its weakening, the pressure on the US dollar will return.

Returning to the report on inflation expectations in the US, they increased last month, which leaves the probability for the return of annual rates to the target level set by the Federal Reserve at 2%.

According to a survey by the Federal Reserve Bank of New York, inflation expectations in June reached 2.7% against 2.5% for the year ahead. The Fed-New York also noted that inflation expectations rose in all groups of respondents.

As noted above, consumer lending in the US continued to grow in May, which is a good signal for the economy, as it will lead to an increase in consumer spending.

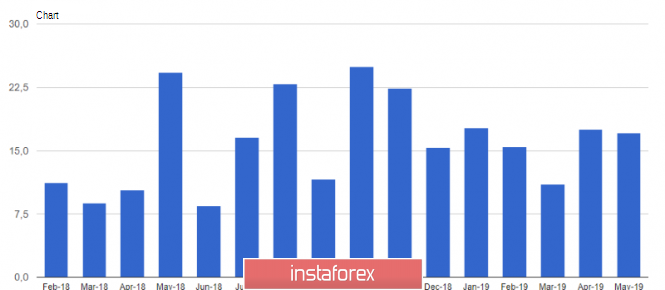

According to the Federal Reserve, unsecured consumer lending in May 2019 increased by 5.0% per annum to $17.09 billion compared to the previous month. Economists had expected credit growth of $17 billion in May.

As for renewable loans, the volume in May increased by 8.2% compared to the same period of the previous year. Non-renewable loans for the reporting period showed an annual growth of 3.9%.

On Monday, a report was also released on the indicator that monitors the situation in the US labor market. Given the growth of respondents who said that difficulties in finding work increased, the index fell in June this year.

According to the Conference Board, the index of employment trends in June was 109.51 points against the May value of 111.22 points. Despite this, it is expected that the long-term growth rate of the index remains at a fairly high level. Let me remind you that in June this year, the number of jobs outside the US agriculture increased by 224,000, and the unemployment rate was 3.7%.

As for the technical picture, sellers of risky assets are gradually returning to the market. At the moment, the large support is located in the area of 1.1205, the breakthrough of which will provide a further bearish trend by new sellers, whose goal will be the lows in the area of 1.1160 and 1.1110. If the bulls try to correct the situation, the upward correction will be limited by a large resistance in the area of 1.1260, where the upper limit of the downward channel passes.