While waiting for reports from the US Energy Information Administration, OPEC, and the International Energy Agency, the oil market naturally fell into consolidation. None of the investors want to force things ahead of time. Each of the opponents can draw both "bullish" and "bearish" black gold market conditions at their discretion so that even a minor new driver can provoke serious changes in quotations.

The prolongation of the agreement between OPEC and other producing countries to minimize production by 1.2 million b/s until the end of March 2020 play on the side of the "bulls". At the same time, this reduces the number of drilling rigs from Baker Hughes, the growing risks of escalating the conflict between the US and Iran in the Middle East and expectations a reduction in the federal funds rate, which will weaken the US dollar, as well as hopes for ending the trade war between Washington and Beijing. On the contrary, Bears are counting on growth in US production, as well as a reduction in US oil reserves, a slowdown in global demand and a return of investor interest in the US dollar due to the Fed's reluctance to loosen monetary policy. Thus, each of the opposing sides has their own trump cards, which contributes to the consolidation of Brent in the range of $59.5-66.5 per barrel.

Dynamics of oil and US dollars

The fact that Russia, Saudi Arabia, and other countries agreed to prolong the Vienna agreement not by 6, but for 9 months should have pleasantly surprised the oil market. Thanks to the cartel's cooperation with Moscow, the North Sea variety has gained more than 20% since the beginning of the year. Meanwhile, the Texan variety has gained more than 27%. If the contract was extended by half a year, one could say that this factor is already taken into account in the quotations and we are expected to sell on the facts. However, three quarters is clear bullish news. If we add to the reduction of drilling rigs in the States from 888 in November to 788 in July (which indicates the reluctance of shareholders to increase production costs), as well as the statement by Saudi Arabia to prevent another attack on a tanker in the Persian Gulf, then Brent and WTI buyers could be optimistic about the future. Alas, their opponents have their own reasons for selling.

Shale mining in the United States grew from a zero level a decade ago to 8.5 million b/d, which allowed the United States to claim the role of the first producing country in the world. The trade war between Washington and Beijing leads to a slowdown in China's GDP, which imports about 9.5 million b/s. Reducing global oil demand extends a helping hand to bears across Brent and WTI. Bloomberg experts expect another reduction in a row for the fourth time in the US black gold reserves, which is at 3.6 million bps this time.

It is possible that oil will swing in one direction or another under the influence of the US dollar. In this regard, Jerome Powell's speech before the Congress and the publication of the minutes of the June FOMC meeting are expected by investors with no less interest than the reports of the Energy Information Administration, OPEC and the IEA.

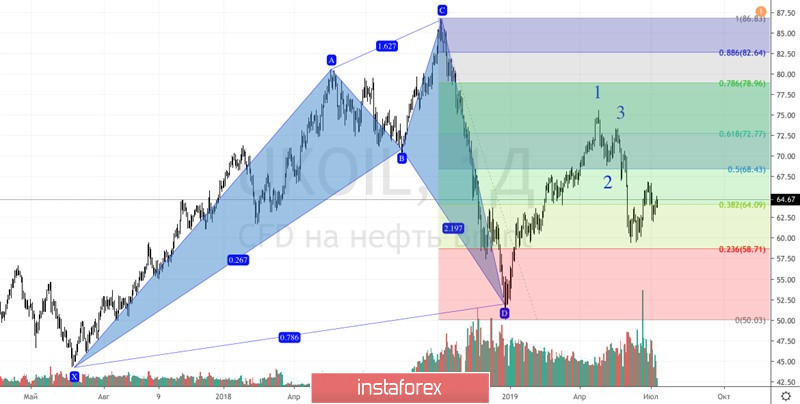

Technically, the option of transforming the "Shark" pattern into 5-0 is still not excluded on the daily chart of Brent.

Brent daily chart